Strength Index Indicator for MT5

$0.00

The Strength Index Indicator, also called the Strength Index Signal, helps traders figure out how strong currencies are in financial markets, especially in forex trading. It was made by traders to give helpful info to traders so they can make smarter trading choices. This indicator utilizes details from currency strength analysis to provide traders with valuable information for making informed trading decisions.

Description

What is the Strength Index Indicator? Strength Index Indicator also known as Strength Index Signal, helps traders determine how strong currencies are in financial markets, especially in forex trading. It was made by traders to give helpful information to traders so they could make smarter trading choices. Moreover, this Indicator is great for forex traders, it helps them see how strong different currencies are. This tool can help traders know if the market is moving fast or slow, so they can make better trades.

Moreover, the Strength Index Indicator simplifies the complex currency strength analysis into an easy-to-understand format for traders. Also, it helps them make informed trades without knowing all the details of currency strength analysis. Using the Strength Index Indicator can make you more confident in trading. Furthermore, it gives useful information and improves your chances of success by analyzing currency strength. Plus, it works well with platforms like MetaTrader 5, making trading easier.

Advantages of Strength Index Indicator:

Here are some potential advantages of this indicator:

Identify Trends and Reversals: It helps traders identify existing and potential trend reversals through oscillator movements and divergences with price.

Overbought and Oversold Signals: The indicator may provide insights into when an asset might be nearing overbought (due for a price drop) or oversold (ripe for a price increase) zones. This can be valuable for traders looking for entry and exit points.

Focus on Currency Strength (for Strength Index Signal): If designed specifically for forex markets, it can offer a unique perspective based on currency strength analysis, potentially helping traders make informed decisions in that specific market.

User-Friendly: It can translate complex analysis into user-friendly format, making it easier for traders to understand, especially for beginners.

How to Trade with a Strength Index Indicator?

The Trend Confirmation Strategy with Strength Index Signal (SIS) is a trading method. It helps confirm if a market trend is happening or might change direction. Traders adjust SIS settings(SIS Period) to see how sensitive it is to trends, and Overbough/Oversold Levels to understand market conditions. Lastly, customizing these settings is important for different trading styles and types of assets.

For long trades, strategy says to buy when the price is going up and SIS indicator is also going up. We look for small dip in price while SIS is going up, and buy when price is near support levels.

For short trades, it’s the opposite. We sell when the price is going down and the SIS is also going down. We look for small rise in price while SIS is going down, and sell when price is near resistance levels.

In both cases, we focus on managing risk. This means setting goals for how much profit we want, placing orders to stoplosses if trade goes bad, and considering using trailing stops to protect our gains.

Features:

Here are some features this indicator can offer:

- Trend Identification: SIS can potentially help identify existing trends(upward/downward) by displaying its direction(above/below midline) and alignment with price movement.

- Trend Confirmation: By looking for compatibility between SIS and price direction, traders use it to confirm accuracy of existing trend.

- Overbought/Oversold Signals: The SIS may have pre-defined levels to indicate when an asset might be nearing overbought or oversold zones.

- Momentum Oscillator: The SIS likely functions as a momentum oscillator, fluctuating between bullish and bearish areas, reflecting the strength and speed of recent price movements.

- Divergence Detection: The SIS might be able to identify divergences between its movement and price action. This can be a valuable tool for spotting potential trend reversals.

- User-Friendly Display: Ideally, the SIS converts complex calculations into a user-friendly format on the trading platform, making it easier for traders to understand and interpret the signals.

- Currency Strength Analysis: If specifically designed for forex markets, the SIS might offer a unique perspective based on currency strength analysis, potentially helping forex traders in making informed decisions.

- Customizable Parameters: Lastly, it allows customization of parameters like the calculation period to customize the indicator to different trading styles and asset classes.

Conclusion

Strength Index Indicator (SIS) is a valuable indicator for forex traders, simplifying currency strength analysis into an easy-to-understand format. It helps identify trends and overbought/oversold signals as well as offers a unique perspective based on currency strength. Finally, customizable parameters make it adjustable to various trading styles, increasing trader’s confidence and decision-making abilities.

DOWNLOAD NOWSettings

- Strength Accumulation period (value = 50)

- Delta (value = 1)

- ATR period (value = 20)

- ATR Delta (value = 1)

Q & A

The SIS helps traders manage risk by setting profit goals, placing stop-loss orders, and considering the use of trailing stops to protect gains.

Customer Support answered on April 22, 2024 store managerBy assessing the alignment between the SIS direction and price movement, traders can use it to confirm the accuracy of existing trends.

Customer Support answered on April 22, 2024 store managerYes, traders can customize parameters such as the calculation period to align with their trading styles and preferences, enhancing its effectiveness.

Customer Support answered on April 22, 2024 store managerThe SIS may indicate when an asset is nearing overbought (due for a price drop) or oversold (ripe for a price increase) zones, aiding traders in finding entry and exit points.

Customer Support answered on April 3, 2024 store managerThe SIS assists traders in identifying both existing trends and potential trend reversals through its oscillator movements and divergences with price action.

Customer Support answered on April 3, 2024 store managerSorry, no questions were found

Ask a question

Your question will be answered by a store representative or other customers.

Thank you for the question!

Your question has been received and will be answered soon. Please do not submit the same question again.

Error

An error occurred when saving your question. Please report it to the website administrator. Additional information:

Add an answer

Thank you for the answer!

Your answer has been received and will be published soon. Please do not submit the same answer again.

Error

An error occurred when saving your answer. Please report it to the website administrator. Additional information:

Related products

-

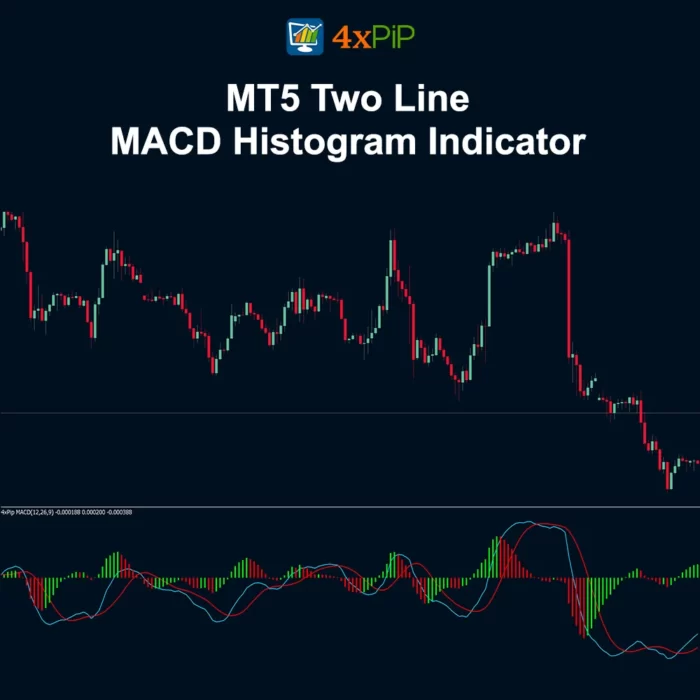

Two Line MACD Histogram Indicator for MT5 – Free Download

Rated 0 out of 5$0.00 Select options -

Free

FreeMT5 EA Rsi

Rated 0 out of 5$100.00Original price was: $100.00.$20.00Current price is: $20.00. Select options -

Free

FreeMT5 Trend Indicator

Rated 5.00 out of 5$0.00 Select options -

Free

FreeAddition of Alerts to your EA indicator MT5

Rated 4.73 out of 5$30.00 Select options

Reach Us on WhatsApp

Reach Us on WhatsApp Fly Over to Telegram

Fly Over to Telegram Drop Us an Email

Drop Us an Email

Martingale EA is a valuable addition to my trading toolkit. It does what it says, but caution and discipline are essential. The counter trades have been a game-changer for me.

Martingale Forex EA is effective, but the 100% winning rate claim should be taken with caution. It’s a valuable tool, but like any strategy, it requires careful consideration and risk management.

Martingale EA has brought more consistency to my trades. It’s not without risks, but if used wisely, it can be a powerful tool in your trading journey. Thumbs up!

Martingale EA is a brilliant creation. The 100% winning rate is not an exaggeration. It has significantly improved my trading success, and the counter trades are a genius addition.

Martingale EA is effective, but the emphasis on a 100% winning rate may mislead some traders. Use it cautiously, and it can be a valuable tool in your trading strategy.