Best Volume Profile for MetaTrader 4 – Download FREE

$0.00

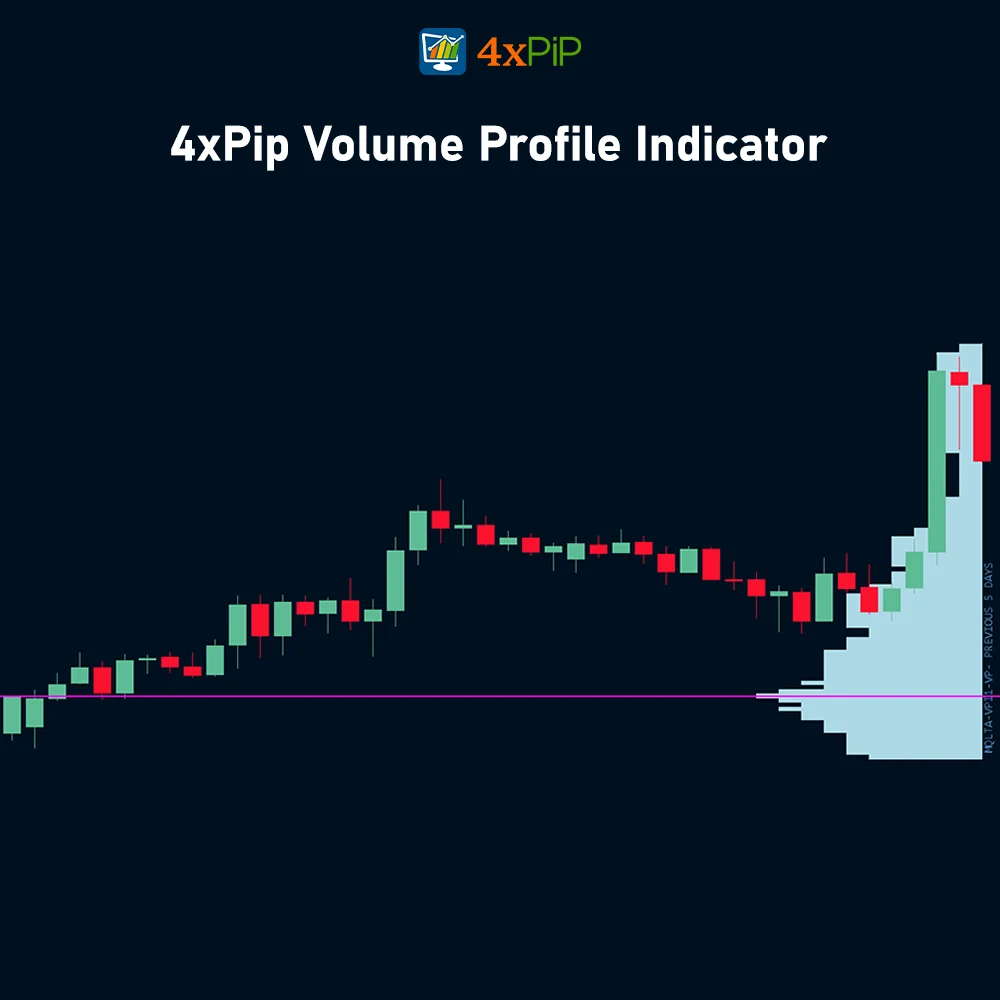

The Volume Profile indicator is an amazing indicator. It helps you find where important price moves happened by showing price levels. The indicator takes into account both buying and selling volumes and displays this information directly on the chart to make it easier for traders to determine the pressure of bulls or bears in the financial market.

Description

What is the Volume Profile Indicator? Volume Profile is a charting method that shows how much trading has happened at different prices over a set time. It uses a histogram on a chart to highlight important price levels based on trading volume. This tool divides the total volume traded at a price level by the overall buying or selling volume during that time. Traders can see this data visually as a histogram on their charts, which helps them spot key levels more easily.

There are many trading strategies that use the Volume Profile as a key component. Typically, many traders use this tool precisely to determine the main support and resistance levels. To do this, traders rely on past price movements, volume behaviour and analyse them. This approach is useful because it helps determine the significance of price levels that the market has already been at.

The Volume Profile indicator is plotted on the asset chart. This approach makes it possible to visually see the market as a whole, identifying the most conceivable currency pairs and timeframes for trading.

Trading Volume

Trading volume is a key factor in forex trading that many traders don’t pay enough attention to in technical analysis. Higher trading volumes often signal potential price reversals, which forex traders see as significant. The Volume Profile indicator for MT4 shows traders areas of low volume, high volume, and a point called Volume Point of Control (VPOC). VPOC, or POC, is a crucial support or resistance level where trading volumes are highest. This makes the market more likely to reverse direction around the VPOC.

How to Trade with Volume Profile Indicator?

Most traders use volume profiles to find support and resistance levels. Volume Profile helps identify these levels based on past price movements and volume behavior. Unlike methods that predict future prices, like trend lines or moving averages, using Volume Profile is reactive—it looks at what’s already happened in the market.

Support levels are where prices tend to stop falling, while resistance levels are where they stop rising. For instance, a price level at the bottom of the profile with a lot of buying volume indicates a strong support level. Similarly, a price level at the top of the profile with high selling volume suggests a resistance level.

Features

Here are some features offered by the volume profile indicator:

- Identify Support and Resistance: Volume Profiles highlight price zones with high trading activity. These zones often act as support (buying interest) or resistance (selling pressure) levels, helping traders anticipate potential price reversals or continuations.

- Volume Distribution Analysis: The indicator visually represents the distribution of volume across different price levels. This allows traders to assess where most of the buying and selling activity has occurred.

- Point of Control (POC): The POC is the single price level with the highest trading volume within the specified timeframe. It represents the price where supply and demand were most balanced.

- Value Area (VA): The VA highlights a specific price range that captures a user-defined percentage of the total volume (usually 70%). This area represents price levels where significant buying and selling took place.

- Identify Market Strength: The volume profile’s shape can offer insights into market strength. A wide and flat profile might suggest a more balanced market, while a profile tilted to one side (high volume on one side) could indicate a directional bias.

- Stop-Loss and Take-Profit Levels: By analyzing volume distribution, traders can identify potential areas to place stop-loss orders below support or take-profit orders above resistance.

- Improved Order Execution: Understanding volume profiles can help traders place orders within price zones with higher liquidity, potentially leading to smoother entry and exit from trades.

- Multiple Range Options: Some Volume Profile indicators offer various range options for calculating the profile. This allows traders to analyze volume activity on specific timeframes (daily, hourly) or within a user-defined price range.

Conclusion

Volume Profile is a really useful tool for traders. It’s versatile and can be used in many different ways. Unlike some other tools, people mostly agree that Volume Profile is helpful. It gives clear data for traders to work with. Traders keep finding new ways to use it. For example, they use it to find support and resistance areas on a chart. But they also use it in more advanced ways. For instance, they compare current events with past data to make trading decisions.

DOWNLOAD NOWSettings

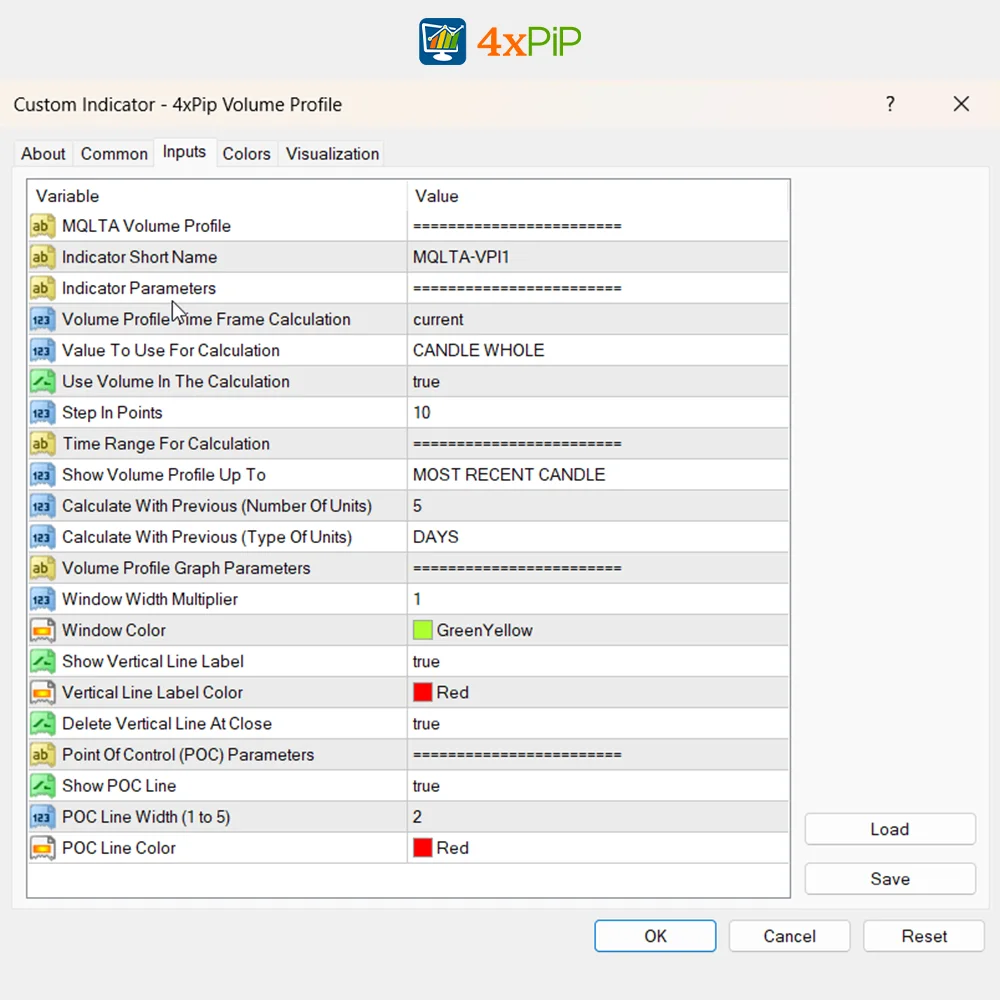

- Volume Profile Time Frame Calculation (value = current)

- Value To Use For Calculation (value = Candle Whole)

- Use Volume In The Calculation (value = true)

- Step In Points (value = 10)

- Time Range For Calculation

- Show Volume Profile Up To (value = Most Recent Candle)

- Calculate With Previous (Number Of Units). (value = 2)

- Calculate With Previous (Type Of Units) (value = Weeks)

- Volume Profile Graph Parameters

- Window Width Multiplier (value = 1)

- Window Color (value = GreenYellow)

- Show Vertical Line Label (value = True)

- Vertical Line Label Color (value = Red)

- Delete Vertical Line At Close. (value = False)

- Show POC Line (value = True)

- POC Line Width (1 to 5): (value = 2)

- POC Line Color (value = Red)

Q & A

While Volume Profile is commonly used in forex trading, it can also be applied to other financial instruments such as stocks, commodities, and cryptocurrencies

Customer Support answered on May 29, 2024 store managerYes, Volume Profile is versatile and can be adapted to various trading styles, including day trading, swing trading, and position trading.

Customer Support answered on May 29, 2024 store managerAdvanced traders may compare current events with past data, use it for analyzing market trends, and integrate it into more complex trading strategies beyond basic support and resistance identification.

Customer Support answered on May 29, 2024 store managerTraders can utilize Volume Profile to identify potential stop-loss and take-profit levels by analyzing volume distribution and placing orders within price zones with higher liquidity.

Customer Support answered on May 28, 2024 store managerYes, Volume Profile's shape can offer insights into market sentiment. A wide and flat profile may suggest a balanced market, while a tilted profile could indicate a directional bias.

Customer Support answered on May 28, 2024 store managerSorry, no questions were found

Ask a question

Your question will be answered by a store representative or other customers.

Thank you for the question!

Your question has been received and will be answered soon. Please do not submit the same question again.

Error

An error occurred when saving your question. Please report it to the website administrator. Additional information:

Add an answer

Thank you for the answer!

Your answer has been received and will be published soon. Please do not submit the same answer again.

Error

An error occurred when saving your answer. Please report it to the website administrator. Additional information:

Related products

-

Free

FreeMT4 Mega Indicator

Rated 4.55 out of 5$0.00 Select options -

Premium

PremiumMT4 BreakEven EA

Rated 4.45 out of 5$99.00Original price was: $99.00.$10.00Current price is: $10.00. Select options -

Free

FreeMT4 Chandelier Exit Indicator

Rated 4.50 out of 5$0.00 Select options -

Free

FreeMT4 EA Bollinger Band

Rated 4.80 out of 5$100.00Original price was: $100.00.$20.00Current price is: $20.00. Select options

Reach Us on WhatsApp

Reach Us on WhatsApp Fly Over to Telegram

Fly Over to Telegram Drop Us an Email

Drop Us an Email

Martingale EA is a powerful addition to my trading arsenal. Recovering losses with counter trades is a brilliant feature. It’s not a guaranteed win every time, but it significantly improves your odds.

Martingale EA is a gem in the Forex world. The Takeprofit feature is spot-on, and the counter trades work wonders. My trading has become more profitable and less stressful.

Impressive EA with a solid strategy. The intelligent forex calculator is a game-changer. My drawdown issues have significantly reduced. Still, remember to use it wisely and manage your risks.

Martingale EA is a gem in the Forex world. The Takeprofit feature is spot-on, and the counter trades work wonders. My trading has become more profitable and less stressful.

Martingale EA has brought more consistency to my trades. It’s not without risks, but if used wisely, it can be a powerful tool in your trading journey. Thumbs up!