Elliott Wave Oscillator Indicator for MetaTrader 4

$0.00

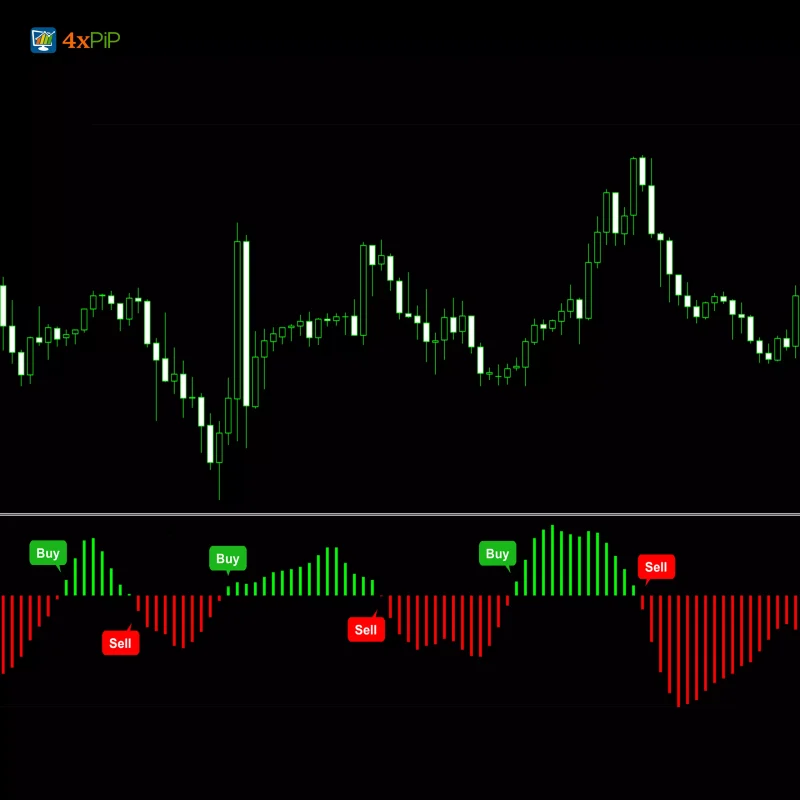

The Elliott Wave Oscillator is an indicator used for technical analysis of price patterns related to changes in investor sentiment and psychology. It identifies impulse waves that follow the trend and corrective waves that go against it and helps traders look for the optimal time when to buy or sell during bullish or bearish trends.

Description

What is the Elliot Wave Theory? Ralph Nelson Elliott came up with the Elliott Wave theory in the 1930s. He looked at charts covering 75 years of stock market data, from yearly to 30-minute intervals, to develop his theory. In 1935, he famously predicted a stock market bottom, which caught people’s attention. Since then, his theory has become popular among many investors and traders.

Elliott laid out rules in his writings to help identify and predict wave patterns in the market. These rules were summarized in a book called R.N. Elliott’s Masterworks, published in 1994. Elliott Wave International is a big company that analyzes and forecasts financial markets using Elliott’s model.

While Elliott’s patterns don’t guarantee future price movements, they can give insight into the possibilities. People often use them alongside other technical analysis tools and indicators to make investment decisions.

Working of Elliot Wave Theory:

This theory says that stock prices go up and down in predictable patterns, like waves in the ocean. These patterns are influenced by how investors feel. There are two main types of waves in this theory: Impulsive waves and corrective waves. It’s not a strict rulebook, but rather a way to understand how prices move. These waves create bigger patterns, like a puzzle. For instance, while looking at a chart for a whole year, you might see a wave going down. But zooming in to just a month, you might notice a wave rising. So, someone using this theory might think the market will go down in the long term but up in the short term.

Impulse Waves:

Impulse waves have five smaller waves. They all move in the same direction as the main trend. This pattern is easy to see in a market and is the most common. Out of these five waves, three go with the trend, while two go against it.

Corrective Waves:

Corrective waves are like corrections in the stock market. They’re made up of three smaller waves that move against the main trend. They aim to push the market back in the direction of the main trend.

Formula

Elliot Wave Oscillator = Fast MA – Slow MA

How to Trade with Elliott Wave Oscillator Indicator?

In a bullish market, traders can buy currency when the second wave ends. To limit potential losses, they can set a stop loss at the lowest point of the first wave. For profit, they aim to sell at the end of the third wave, and the same strategy applies to the fifth wave.

On the other hand, in a bearish market, traders sell currency at the start of the third wave, placing a stop loss above the highest point of the first wave. Profit is taken at the end of the third wave.

This trading method focuses on the third and fifth waves, ignoring the others as they usually go against the trend. Traders enter at the beginning of the third wave and exit at the end of the fifth.

The Elliott wave principle relies on identifying support and resistance levels using the highs and lows of the waves.

The Elliott wave count indicator for MT4 can be used across different timeframes, from intraday to daily, weekly, and monthly charts. Since Elliott waves repeat patterns on different scales, it’s effective for analyzing multiple timeframes to find the best entry points.

Features:

Here are some features offered by Elliot Wave Oscillator Indicator:

- Wave Identification Support: This indicator can assist traders in identifying the different waves within the Elliott Wave theory framework. While not definitive, it can provide clues regarding the structure of the current price movement.

- Potential Trend Confirmation: The oscillator’s values can signal potential trends by indicating impulsive and corrective wave phases.

- Overbought/Oversold Areas: Like other technical indicators, the Elliot Wave Oscillator may reach extreme highs or lows, suggesting possible overbought or oversold conditions.

- Divergence Analysis: Divergences between the indicator’s readings and price action can provide insights into potential trend reversals, similar to the way divergences are used with other oscillators.

- Customization Options: Some Elliot Wave Oscillator variations allow for customization of parameters, enabling traders to adjust the indicator’s sensitivity to their preferences.

- Multi-Timeframe Compatibility: The indicator can potentially be applied across various timeframes, allowing for analysis of different market cycles.

- Complementary Usage: The Elliot Wave Oscillator is often used in conjunction with other technical analysis tools for a more comprehensive market understanding.

Conclusion

The Elliott Wave Oscillator is a technical analysis indicator used in Forex trading, based on Ralph Nelson Elliott’s theory developed in the 1930s. It identifies impulse and corrective waves within market trends, helping traders determine optimal entry and exit points. By analyzing wave patterns, traders can make informed decisions to buy or sell currencies. The oscillator provides insights into investor sentiment and psychology, offering features such as wave identification support, trend confirmation, overbought/oversold indications, and customization options. It is commonly used alongside other technical analysis tools for a detailed market analysis.

DOWNLOAD NOWSettings

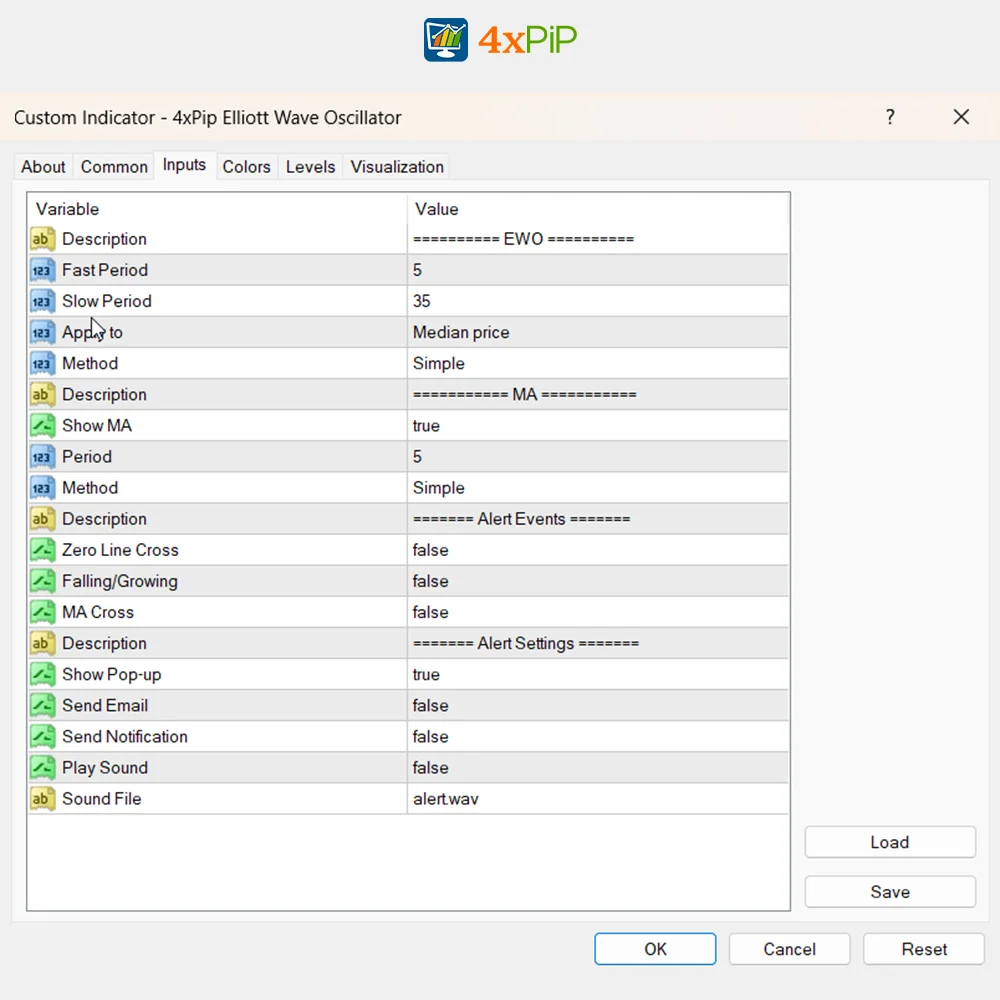

- Description: EWO

- Fast Period (Value = 5)

- Slow Period (Value = 35)

- Apply to (Value = Price Median)

- Method (Value = SMA)

- Description: MA

- Show MA (Value = True)

- Period (Value = 5)

- Method (Value = SMA)

- Description: Alert Events

- Zero Line Cross (Value = False)

- Falling/Growing (Value = False)

- MA Cross (Value = False)

- Description: Alert Settings

- Show Pop-up (Value = True)

- Send Email (Value = False)

- Send Notification (Value = False)

- Play Sound (Value = False)

- Sound File

41 reviews for Elliott Wave Oscillator Indicator for MetaTrader 4

| 5 star | 41% | |

| 4 star | 58% | |

| 3 star | 0% | |

| 2 star | 0% | |

| 1 star | 0% |

Q & A

As with any trading strategy, there are risks involved, including market volatility, unexpected events, and incorrect wave interpretations. Traders should exercise caution and conduct thorough analysis before making trading decisions.

While Elliott's patterns don't guarantee future price movements, they offer valuable insights into market dynamics and potential scenarios. Traders often use them alongside other technical analysis tools for more accurate predictions.

Divergences between the oscillator's readings and price action can provide insights into potential trend reversals, similar to how divergences are used with other oscillators.

Yes, the oscillator can be applied across various timeframes, from intraday to daily, weekly, and monthly charts, enabling traders to analyze different market cycles and find the best entry points.

Yes, some variations of the oscillator offer customization options, allowing traders to adjust parameters to suit their trading preferences and strategies.

Reach Us on WhatsApp

Reach Us on WhatsApp Fly Over to Telegram

Fly Over to Telegram Drop Us an Email

Drop Us an Email

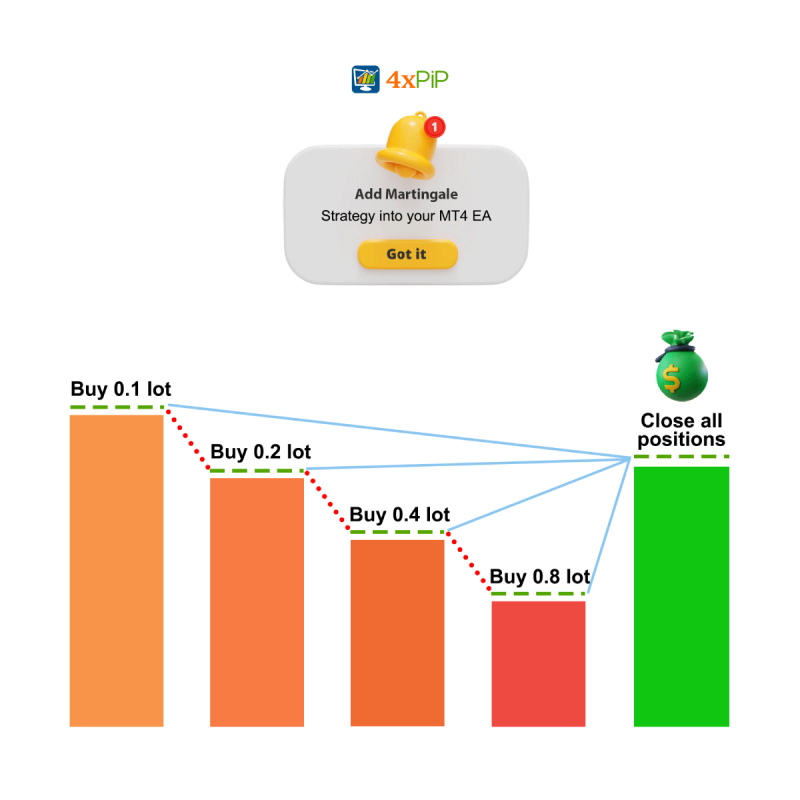

Martingale Forex EA is a powerful tool, especially for navigating volatile markets. The 100% winning rate is a bit optimistic, but with proper risk management, it can be a game-changer.

Martingale Forex EA is effective, but the 100% winning rate claim is a bit too optimistic. It’s crucial to manage expectations and use the EA as a part of a comprehensive trading strategy.

Martingale Forex EA is effective, but don’t let the 100% winning rate claim lull you into complacency. It’s a tool, not a guarantee. Use it wisely, and it can enhance your trading.

Martingale EA is a valuable addition to my trading toolkit. It does what it says, but caution and discipline are essential. The counter trades have been a game-changer for me.

The EA is effective, but caution is key. The 100% winning rate claim might be a bit exaggerated. Nonetheless, it’s a valuable tool if used with a solid risk management plan.