Swing trading, a strategy delving into short-term price movements, holds immense potential for traders aiming to capitalize on market fluctuations. As you embark on this journey, understanding the basics becomes paramount.

Understanding the Basics of Swing Trading:

Swing trading, though intricate, demands a grasp of fundamentals. Before venturing into this strategy, comprehend the diverse swing trading approaches, associated risks, and essential best practices.

Selecting Your Swing Trading Strategy:

Amid numerous strategies, choose one aligning with your risk tolerance, trading experience, and lifestyle. A strategy that resonates with your profile sets the stage for a successful trading journey.

Backtesting: A Crucial Step in Your Strategy

Validation through backtesting is pivotal. Assess your chosen strategy’s historical performance, identifying and rectifying potential issues. Confidence in your strategy is key before venturing into the live trading arena.

Embarking on Your Trading Journey:

With a tested strategy, dive into the market. Adhere to risk management rules and exit trades when stop-loss orders trigger, ensuring a disciplined and strategic approach to trading.

Exploring Popular Swing Trading Strategies:

Breakout Trading: Riding Momentum Waves

Capture momentum by buying stocks breaking above key resistance or selling when breaching support. Momentum is a powerful force in the market.

Moving Average Trading: Identifying Trends with Precision

Utilize moving averages to pinpoint support, resistance, and trend reversals. A refined technique to navigate market trends.

Chart Pattern Trading: Decoding Market Signals

Uncover potential trend reversals or continuations through chart patterns like head and shoulders, double tops, and triangles.

Pivot Point Trading: Navigating Market Swings

Navigate market swings by identifying potential support and resistance levels using pivot points. A strategic approach to market dynamics.

Examples of Effective Swing Trading Strategies:

Explore real-world applications:

Breakout Strategy: Buy above the 50-day moving average; sell below it. Leverage momentum for profitable trades.

Moving Average Crossover Strategy: Identify trend shifts by monitoring crossovers between the 50-day and 200-day moving averages.

Head and Shoulders Pattern: Capitalize on trend reversals by entering above the neckline and exiting below.

Pivot Point Strategy: Time entries and exits based on rebounds from daily pivot points and resistance levels.

Choosing the Right Trading Platform:

Navigate the plethora of options:

Fidelity: User-friendly, educational, with no account minimum. Ideal for beginners exploring the trading landscape.

Interactive Brokers: Low fees, powerful platform, but complex for beginners. A $10,000 account minimum adds entry barriers.

TD Ameritrade: User-friendly with low fees, but higher options fees. An accessible option with a $2,500 account minimum.

Deciding Your Best Fit:

Consider individual needs:

Account Minimum: Align with your budgetary constraints.

Fees: Scrutinize trading costs for stocks, ETFs, options, and other securities.

Platform Features: Choose a platform meeting your requirements, whether advanced charting tools or paper trading.

Educational Resources: Assess platforms offering educational support for your learning journey.

Opening Your Swing Trading Account:

Navigate the account setup process:

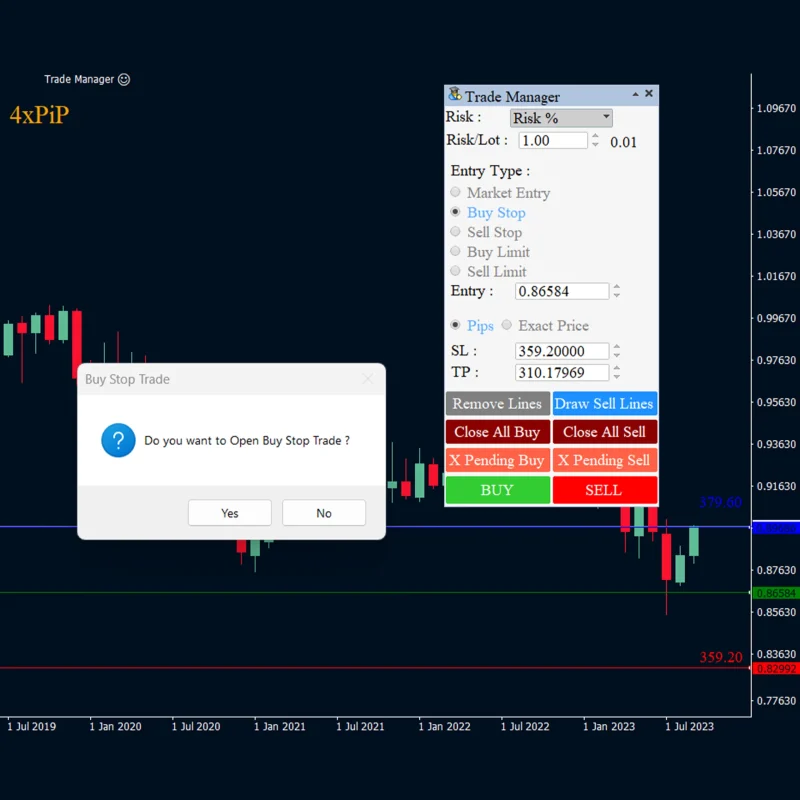

Choose a Broker: Compare fees, features, and platforms.

Open an Account: Fill out an online application with personal and financial details.

Fund Your Account: Allocate sufficient funds for trading.

Choose Markets and Vehicles: Select markets and trading instruments aligned with your strategy.

Research and Identify Opportunities: Utilize technical analysis to spot potential trades.

Enter, Manage, and Exit Trades: Execute strategic trades, manage positions, and exit at opportune moments.

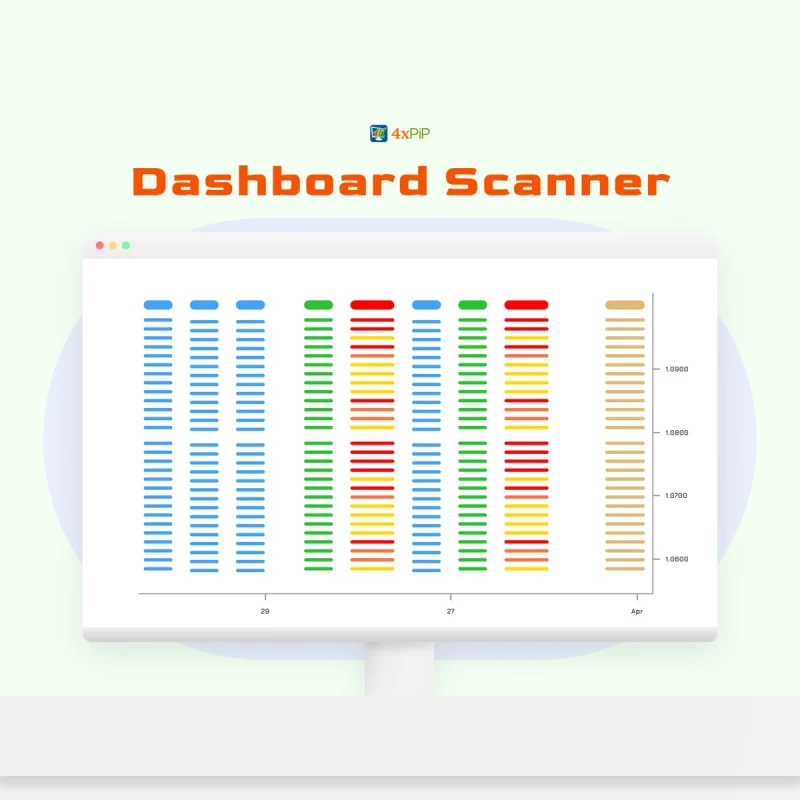

Leveraging Stock Screeners for Trading:

Pricing: Assess screener costs to fit your budget.

Features: Opt for screeners offering necessary features like custom screens and backtesting.

Exchanges Covered: Ensure the screener covers exchanges relevant to your trading interests.

Top Stock Screeners for Swing Trading:

Trade Ideas: AI-powered with robust features, starting at $118 per month.

FINVIZ: Popular and affordable at $24.96 per month.

Zacks: Comprehensive metrics starting at $249 per year.

Stock Rover: Diverse features starting at $7.99 per month.

TC2000: Powerful tools at $9.99 per month.

TradingView: Global coverage starting at $14.95 per month.

Tips for Swing Trading Success:

Develop a Trading Plan: Establish a clear strategy and stick to it.

Use Stop-Loss Orders: Limit losses with strategic exits.

Take Profits Wisely: Secure gains when in a winning position.

Manage Risk Effectively: Prioritize risk management in all trades.

Research Before Deciding: Make informed decisions through thorough research.

In your swing trading venture, mastering these elements ensures a robust foundation. Remember, diligence and strategic planning are your allies in navigating the dynamic world of swing trading.

Conclusion:

In conclusion, swing trading offers dynamic opportunities for profit. Armed with diverse strategies and informed decisions, success awaits.