Stochastic Divergence Indicator for MetaTrader 4 | Download FREE

$0.00

The Stochastic Divergence Indicator for MT4 automatically detects classic divergence and reverse divergence between price and the standard Stochastic oscillator. It plots divergence lines directly on the chart and sends alerts when a potential reversal forms. The tool helps traders identify weakening momentum, trend exhaustion, and early reversal points without manually checking the Stochastic.

Description

What does the Stochastic Divergence Indicator Do?

This indicator scans price movements and compares them with the Stochastic oscillator to find divergence signals. It detects when price creates a new high or low, but the Stochastic does not confirm it. This mismatch often indicates a possible reversal or correction, and the indicator marks it with clear divergence lines.

How Does Stochastic Divergence Indicator work on the MT4 chart?

You do not need to attach a Stochastic manually. The indicator calculates divergence internally. But if a standard Stochastic is placed on the chart, the indicator will use its settings and draw matching divergence lines both on the price chart and inside the Stochastic window. Solid lines show classic divergence, while dotted lines display reverse divergence.

Why is Divergence Useful for Traders?

Divergence helps traders identify when momentum weakens before the trend changes. It gives an early warning of possible reversal zones. This is useful for entry confirmation, exit decisions, and improving overall market timing in any trading strategy.

How Can Traders Use Stochastic Divergence Indicators in Real Trading?

Traders can use divergence signals for trend reversals, pullback entries, and momentum analysis. The indicator also supports alerts, making it easier to monitor multiple pairs without watching charts constantly.

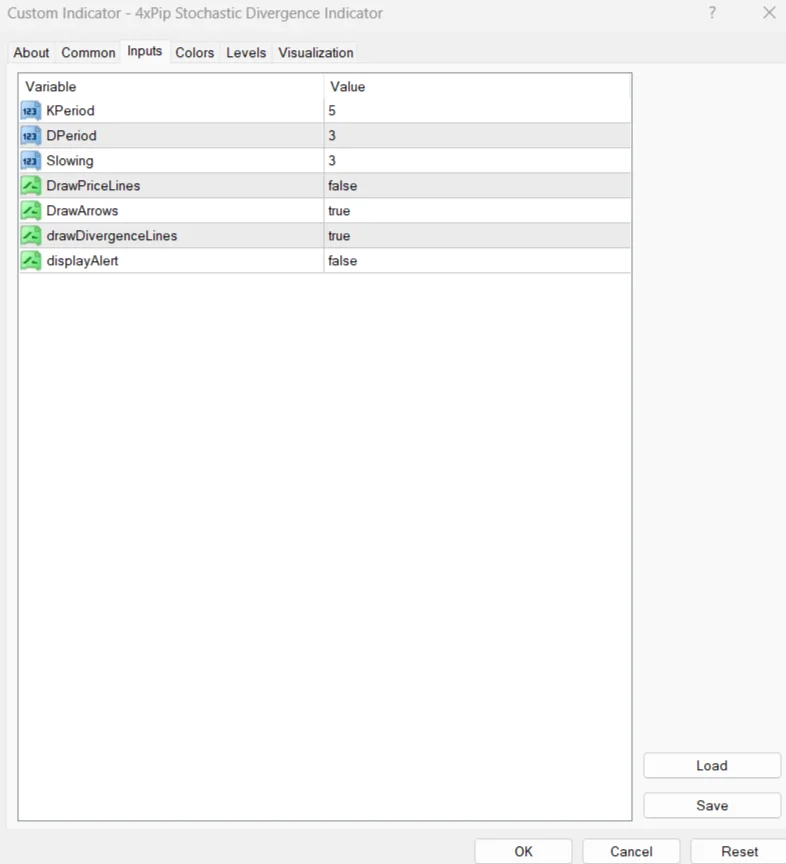

What Customization Options does the Indicator Support?

Users can adjust divergence line colors, choose alert types, and select different languages for notifications. This allows traders to integrate the indicator into any trading setup.

How Traders Spot Reversals Using Stochastic Divergence Indicator for MT4

A practical way to implement the Stochastic Divergence Indicator is to use it as a reversal-confirmation tool. When the indicator marks classic or reverse divergence, wait for price to break a minor structure level or form a confirming candlestick pattern before entering. This keeps you from jumping into every signal and focuses trades on moments when momentum and structure agree.

You can also use it as a pullback-entry filter in trending markets. When price retraces and divergence forms against the pullback, prepare for a continuation entry once Stochastic turns back in the direction of the trend. Set stops beyond the divergence swing and target previous highs/lows or the next key zone for controlled, rule-based trade management.

Advantages

- Detects classic and reverse divergence automatically.

- Works even without attaching a Stochastic to the chart.

- Provides early reversal signals for better timing.

- Draws divergence on both price and Stochastic windows.

- Supports alert notifications for quick responses.

- Reduces manual chart scanning and analysis time.

- Helps identify trend exhaustion and momentum weakness.

- Improves entry and exit accuracy.

- Simple settings suitable for all trader levels.

- Uses standard Stochastic logic for reliable signals.

Features

- Automatic divergence detection algorithm.

- Solid line for classic divergence identification.

- Dotted line for reverse divergence visualization.

- Customizable ColorBull and ColorBear settings.

- Alert mode selection (pop-up, sound, push).

- Multi-language alert support.

- Works with standard Stochastic parameters.

- Draws signals on both chart and indicator window.

- Lightweight coding for smooth MT4 performance.

- Compatible with all symbols and timeframes.

How to Trade

Traders use the Stochastic Divergence Indicator for MT4 to spot early signs of market reversals by comparing price movement with the direction of the stochastic oscillator. When price makes a new high or low but the stochastic fails to do the same, it signals weakness in the current trend. This mismatch helps traders identify when momentum is slowing down, even before the trend fully changes. As a result, they can prepare for possible turning points in the market.

The indicator also highlights divergence visually, making it easier to confirm potential reversal zones without manually checking each swing. Traders often combine these signals with support and resistance levels to strengthen their analysis. When divergence appears at a key level, the chances of a reversal increase. This simple but reliable approach helps traders enter trades earlier with better risk-to-reward opportunities.

Formula

%K=(C−L14H14−L14)×100

C = The most recent closing price

L14 = The lowest price traded of the 14 previous trading sessions

H14 = The highest price traded during the same14-day period

%K = The current value of the stochastic indicator

Conclusion

The Stochastic Divergence Indicator for MT4 is a simple and effective tool for spotting early market reversals. It detects classic and reverse divergence, draws clean visual signals, and supports alerts for quick decision-making. With full customization options and accurate Stochastic-based logic, it helps traders improve market timing and understand momentum behavior in any trading condition.

DOWNLOAD NOW

Reach Us on WhatsApp

Reach Us on WhatsApp Fly Over to Telegram

Fly Over to Telegram Drop Us an Email

Drop Us an Email

Reviews

There are no reviews yet