Dec 5, 2023 – Zain Vawda, Analyst. In this article, we delve into the recent ISM Services data and JOLTs job openings, analyzing their impact on the US Dollar.

US ISM Services Performance:

The US ISM services PMI exceeded expectations, reaching 52.7 in November 2023, marking the 11th consecutive month of expansion. Growth was attributed to increased business activity and slight employment growth, reflecting a positive trend in the services sector.

Key Metrics:

New orders maintained strength at 55.5, while inventories rebounded to 55.4. Price pressures eased slightly to 58.3, with a reversal in the backlog of orders (49.1 vs 50.9). Suppliers improved delivery speed (49.6 vs 47.5). Concerns linger about inflation, interest rates, and geopolitical events.

JOLTs Job Openings Plunge:

Job openings dropped to 8.7 million in October, a 30-month low. Hires and total separations remained stable. Job openings in health care and social assistance and finance and insurance declined, while the information sector saw an increase.

US Economy and Dollar Outlook:

Ahead of the FOMC Meeting and with the NFP report pending, the Dollar maintains an upward trajectory. Safe-haven demand and reduced rate cut expectations contribute. Fed policymakers’ mixed signals may create uncertainty.

Market Reaction:

The Dollar Index (DXY) initially sold off post-data but recovered. DXY tested the 200-day MA before bouncing, facing resistance around 103.50. Limited DXY downside is expected, but a slight pullback might precede the NFP report as traders consider profit-taking.

Conclusion:

In this dynamic market, understanding the influence of economic indicators like ISM Services and JOLTs job openings is crucial. Stay informed to navigate trading decisions effectively.

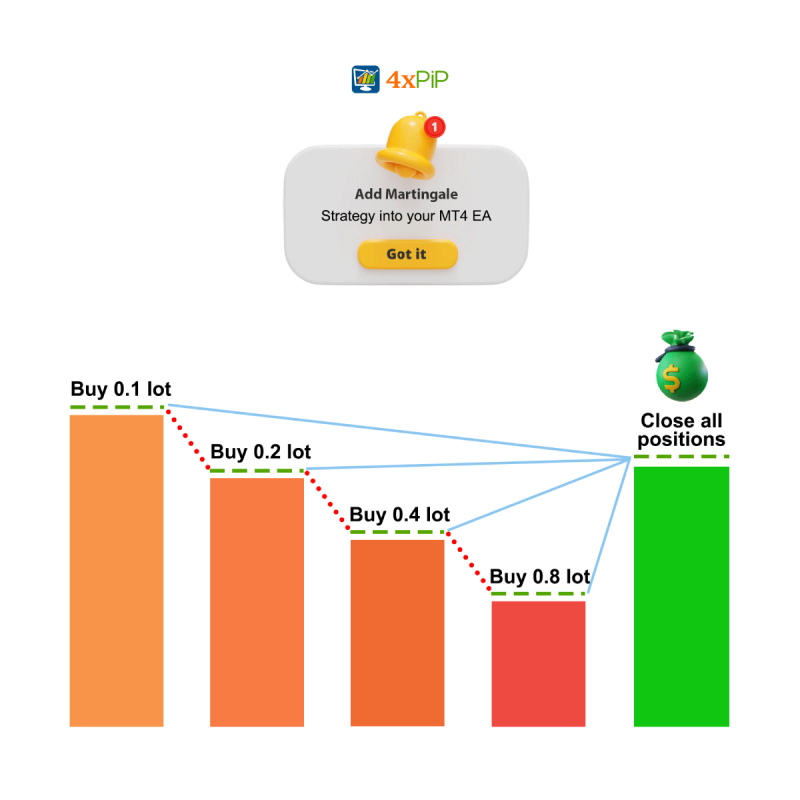

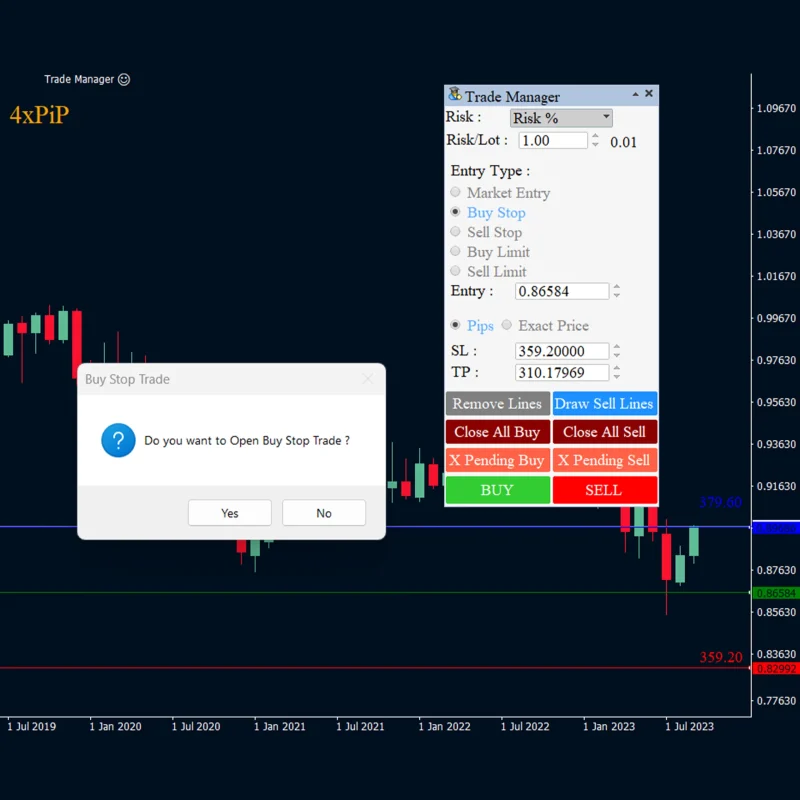

For valuable insights and tools, visit 4xPip – your trusted partner in trading. Explore our range of Expert Advisors and Indicators for automated trading. Contact [email protected] for guidance.

Trade smarter with 4xPip – empowering your trading journey.