Knowing how to calculate drawdown in MetaTrader 4 (MT4) is essential for traders who want to check how well their trading accounts are doing. Drawdown shows how much your account decreases after a series of losing trades, measured as a percentage or dollar amount from the highest point to the lowest. This number is important because it affects a trader’s performance, mindset, and risk.

To understand drawdown in MT4, look at the highest value of your account and see how much it goes down afterward. For example, if your account reaches $10,000 at its peak but then drops to $7,000, the drawdown is $3,000 or 30%. This calculation helps you see how well your account can handle losses, allowing you to make smarter decisions about risk and managing your portfolio.

To calculate drawdown in MT4, use this formula:

Drawdown %=(Peak Value−Trough Value)/Peak Value×100

If you want to learn about drawdown in MT4, try the Drawdown EA for MT4. It’s an Expert Advisor that helps track drawdown automatically and gives you real-time updates about your account. For more info, contact us at [email protected].

Account Protector for MetaTrader 4 and MetaTrader 5

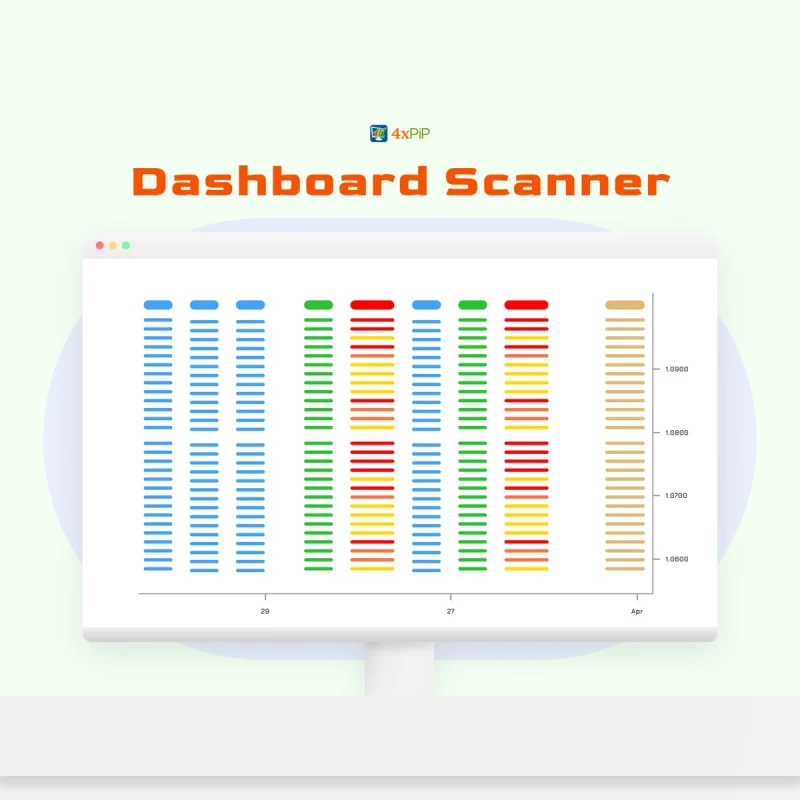

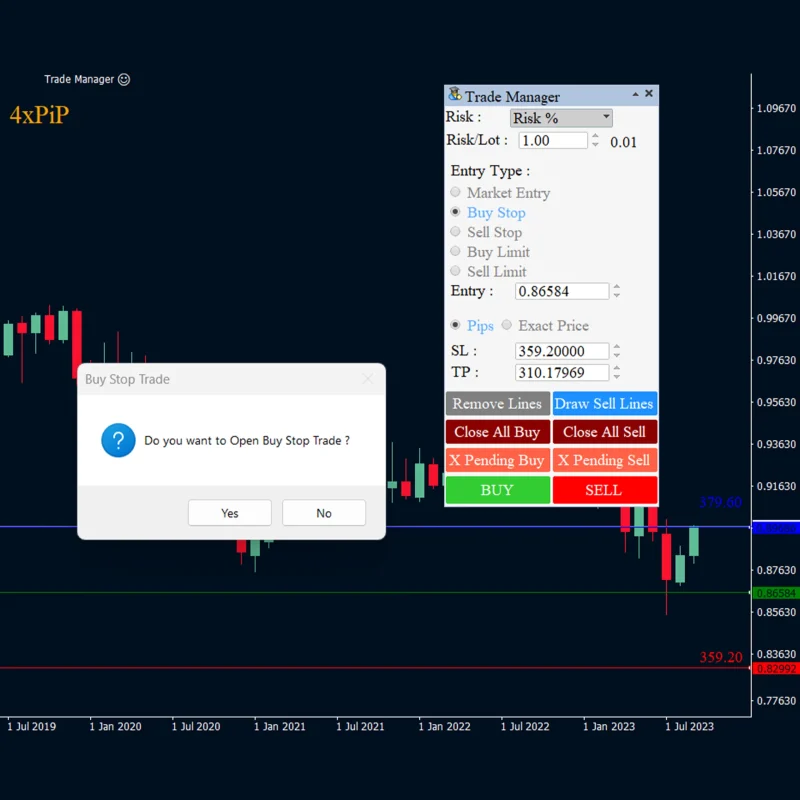

The Account Protector is a helpful tool for MetaTrader 4 (MT4) and MetaTrader 5 (MT5) users. It makes managing trading accounts easier by automating emergency position closing and other trade management tasks.

With the Account Protector, traders can use a simple chart panel to set conditions based on things like account equity, free margin, profit/loss, number of trades, and more. It also lets traders configure filters for positions/orders, use breakeven and trailing stop mechanisms on multiple trades, and schedule actions based on time or price.

A cool feature of the Account Protector is the custom settings files. Traders can save their preferences, making it easy to fill in the panel fields with their favorite settings. This customization gives traders more control and makes their trading experience more efficient.

Optimizing Trading Strategies with Equity Protector

When you’re using Equity Protector to decide when to buy or sell, you can follow different strategies. Technical analysis involves looking at price charts and indicators on MetaTrader platforms. It helps you predict where prices might go. On the other hand, fundamental analysis considers factors like economic indicators, company performance, and world events that could affect an asset’s value. Combining both analyses helps you understand the market and make smart decisions.

To make more money with Equity Protector, use strategies like focusing on risk-reward ratios. This means ensuring potential profits are higher than potential losses in each trade. Keep an eye on market trends, stay updated with news, and use advanced trading strategies like following trends or momentum trading. Continuous learning and adapting to market changes are crucial for finding opportunities and dealing with challenges.

When deciding on stop loss, take profit, and lot size, consider your risk tolerance and the market conditions. The risk-reward ratio helps determine the best levels for stop loss and take profit. The specific values depend on factors like market volatility and your willingness to take risks. Match your lot size to your account size and the percentage of money you’re willing to risk in each trade.

Creating a solid risk management plan is essential for Equity Protector users. This plan helps balance making profits and avoiding significant losses. By applying these strategies and features, you can maximize your trading and navigate the changing and sometimes unpredictable financial markets more effectively.

Best Drawdown Strategy

For traders looking to protect their money and emotions, effectively handling drawdowns is important. There are different strategies for this.

One popular strategy is the 4% rule. In the first year of retirement, you take out 4% of your savings and adjust for inflation each year. This gives you a steady income, but it may not work well if the market isn’t doing great.

Another strategy is the percentage-of-portfolio approach. You take out a fixed percentage of your savings every year. This gives you confidence that you won’t run out of money, but your yearly spending depends on how well the market is doing.

The fixed-dollar strategy involves taking out the same amount of money every year. It’s predictable, but it might not keep up with inflation and market changes, possibly using up your savings faster.

Understanding these strategies helps traders choose the one that fits their goals and risk tolerance, ensuring a strong plan for handling drawdowns.

How to Handle Drawdown?

Dealing with losses like an expert involves using smart strategies and staying focused. Traders can follow these tips to handle losses well:

Know Your Historical Max Drawdown:

Knowing how much things dropped in the past helps us figure out how bad they’re dropping now and lets us set realistic expectations.

Cut Back Trading Size:

Reducing the amount you trade when you’re losing money helps lower the risk and keeps your money safer, making your investment portfolio stronger.

Increase Risk-Reward Ratio:

Making smarter choices that balance risk and reward can boost your profits. It means you’ll need fewer trades to recover from losses, and it strengthens your commitment to disciplined trading.

Review Trading Plan and Performance:

Checking your trading plans and how well you’re doing regularly is important. It helps find mistakes or things that cause losses. Learning from these and making changes is crucial for getting better over time.

Stay Positive and Avoid Emotional Trading:

Staying positive and confident when facing losses is important. Don’t let emotions control your trading; concentrate on the trading steps, not just the results, for a more disciplined approach.

To better manage your account, try using Expert Advisors like the Drawdown EA for MT4 and Drawdown EA for MT5. These EAs track your account’s drawdown in real-time, giving you useful insights. If you want to learn more and enjoy these benefits, contact our experts at [email protected].

Additional Insights

To better handle losses in trading, check out different tools like Account Protector, risk management indicator, and Drawdown EA. Compare them to understand your options.

Learn from a trader’s experience with Account Protector in a case study. See how it helped recover from losses. Consider your own trading style and risk tolerance to make smart choices.

Take action now! Try Account Protector yourself. Share feedback or questions with our experts at [email protected] for a better trading experience.

Summary

This guide helps traders understand drawdowns better. Learn how to calculate drawdown in MetaTrader 4 and use the Account Protector for MT4 and MT5 to automate trade management. The blog covers practical drawdown strategies, stressing the need for discipline. It also compares the Account Protector with other tools, shares case studies, and invites readers to try it for personalized trading. For more help and to make the most of the Account Protector, contact 4xPip‘s experts at [email protected].