In the dynamic world of forex, news trading stands out as a technique leveraging breaking news to capitalize on market volatility. This strategy revolves around key events such as economic data releases, interest rate changes, and earnings reports that can significantly impact currency values. At 4xPip, your trusted source for trading tools, we delve into the nuances of news trading to empower you with strategies for navigating this exciting but challenging terrain. Connect with us at [email protected] for expert guidance on enhancing your trading journey.

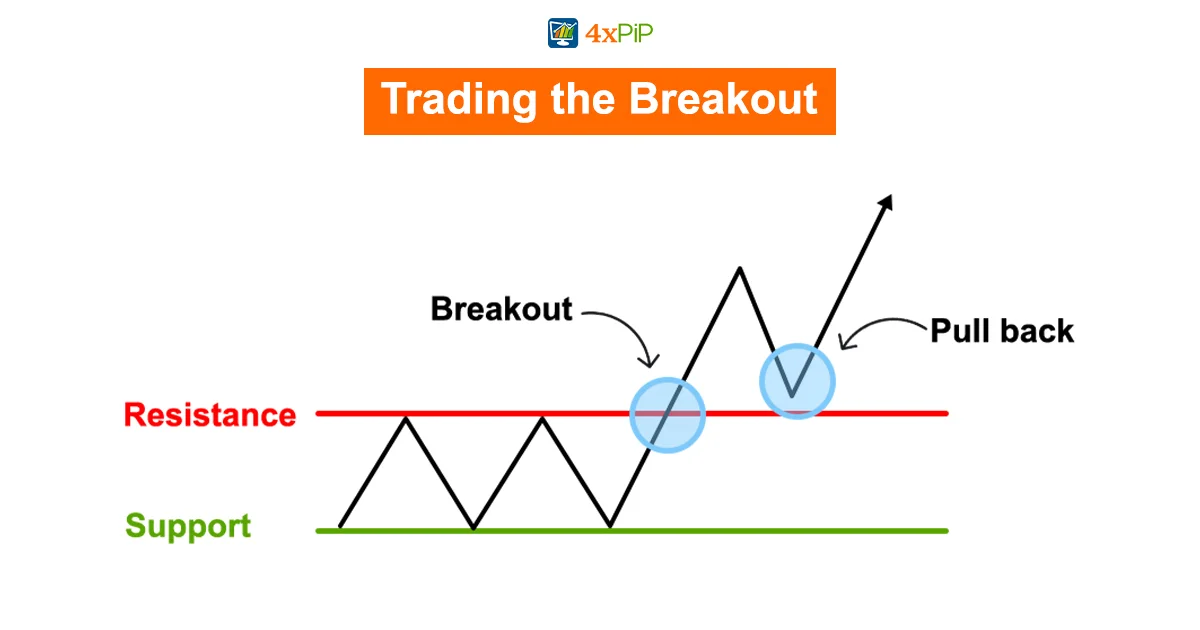

Trading the Breakout

Overview:

News traders often deploy the breakout strategy, identifying periods of consolidation before major news events. The goal is to act swiftly, capitalizing on the price surge or decline post-news release. Execution speed and a clear exit strategy are paramount, as prices can reverse rapidly.

Execution Tips:

Identify consolidation patterns before major news. Traders need to keenly observe charts for signs of price consolidation or range-bound trading before significant news events. Recognizing these patterns is crucial for anticipating potential breakouts.

Execute trades promptly after news release. Given the volatile nature of markets post-news, traders employing the breakout strategy must be prepared to act swiftly. A delay in execution can lead to missed opportunities or entering the market at less favorable prices.

Have a clear exit plan to manage risks effectively. Volatility in the aftermath of news releases can be intense, making it imperative for traders to have a well-defined exit strategy. This could involve setting stop-loss orders to limit potential losses or securing profits through timely exits.

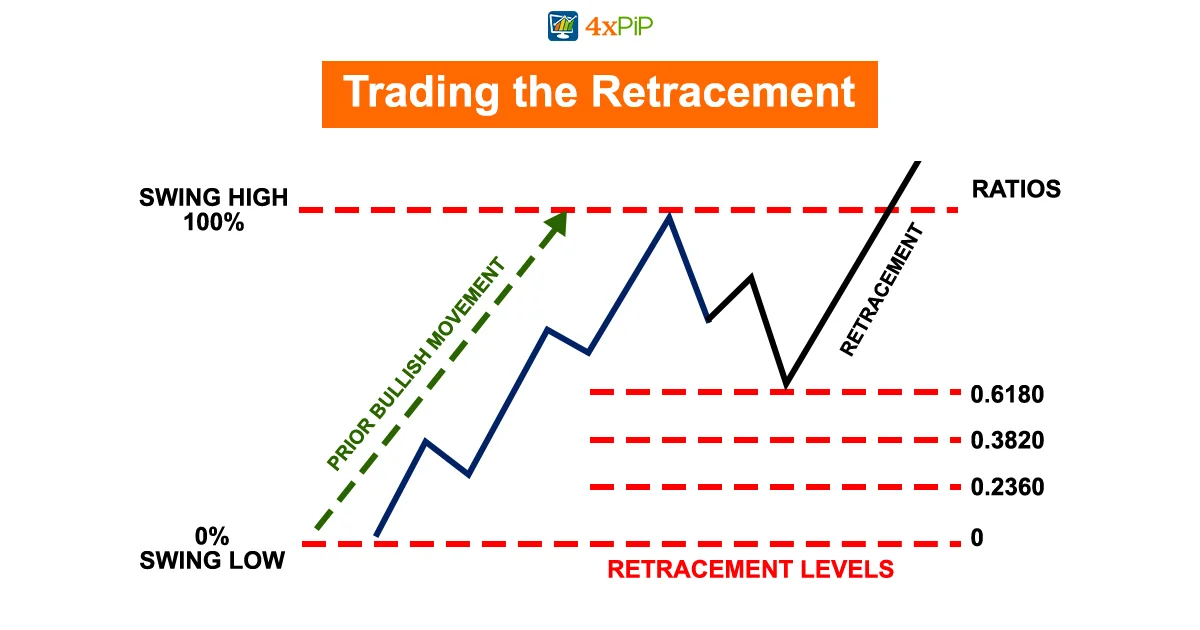

Trading the Retracement

Overview:

The retracement approach involves waiting for prices to pull back post-news before entering a trade aligned with the original trend. This method demands patience and a deep understanding of market sentiment and fundamentals.

Execution Tips:

Wait for the price to retrace after significant news moves. Traders employing retracement strategies should exercise patience and allow the market to undergo a temporary pullback post-news. This retracement provides an entry point aligned with the prevailing trend.

Enter trades in the direction of the original trend. After identifying a retracement, traders should enter the market in the direction of the original trend. This ensures alignment with the broader market sentiment and enhances the probability of a successful trade.

Understand market sentiment and fundamentals for effective retracement trading. Successful retracement trading requires a nuanced understanding of market sentiment and fundamentals. Traders should consider factors such as investor sentiment, economic indicators, and broader market conditions to make informed decisions.

Trading the Divergence

Overview:

Divergence trading involves comparing actual news outcomes with market expectations, seizing opportunities presented by any discrepancies. A bearish divergence, for instance, can signal a potential sell opportunity.

Execution Tips:

Analyze the actual news outcome against forecasts. Traders engaging in divergence trading need to meticulously compare the actual outcome of news releases with market expectations or forecasts. This analysis forms the basis for identifying potential divergence opportunities.

Capitalize on discrepancies between news and market reactions. Divergence traders should be ready to capitalize on situations where the market reaction does not align with the news outcome. This discrepancy can present trading opportunities, such as entering a position contrary to the initial market movement.

Exercise caution, as divergences may be short-lived or insignificant. While divergence trading can be lucrative, traders should exercise caution. Divergences may be short-lived, and not all discrepancies between news and market reactions may result in sustained trends. A disciplined approach is crucial.

Strategies for Successful News Trading

To embark on a successful news trading journey, certain tools and strategies are indispensable. Access to a reliable and swift news source, an economic calendar, and a trading platform for rapid order execution and risk management are crucial. Develop a robust trading plan, adopt effective risk management strategies, and maintain a disciplined mindset to navigate the challenges of news trading. Remember, news trading is both exciting and risky; hence, only trade with funds you can afford to lose.

In conclusion, news trading is a dynamic strategy that can be both exciting and rewarding when executed with precision. By understanding various news trading methods and employing the right tools and strategies, traders can unlock profit opportunities in the ever-evolving forex market. Stay tuned for more insights and tips on trading and risk management from 4xPip.

Summary

Delving into the intricacies of news trading, this comprehensive guide explores three key strategies: Trading the Breakout, Trading the Retracement, and Trading the Divergence. From swift execution tips to the nuances of market sentiment, each strategy demands a unique approach. Backed by insights from 4xPip, a trusted trading tools provider, this guide empowers traders to navigate the dynamic forex landscape with expertise and precision. For personalized guidance, connect with 4xPip’s experts at [email protected].