Do you ever feel like the foreign exchange market moves too fast for you to react? Picture this, You can set up your trades to happen automtically following specific rules. This means you don’t have to constantly watch the screen. Programming for forex trading platforms opens up many opportunities for traders who want to step up their game. Among the various platforms available, MetaTrader 5 (MT5) stands out as a popular choice among traders worldwide. What sets MT5 apart is its versatility and the ability to customize through a specialized programming language called MQL5. We dive into automated trading systems. We have experienced and talented MQL5 programmers and coders that can program and modify custom trading bots and programs. From Automated Trading Bots to the experts in various programming languages, we provide everything at our website 4xPip. For further questions and inquiries contact us at [email protected]

Key Components of Trading Platforms:

A forex trading platform is the software interface that allows traders to access the forex market and execute trades. While the specific features and functionalities may vary from one platform to another, there are several key components that are common to most trading platforms:

User Interface (UI):

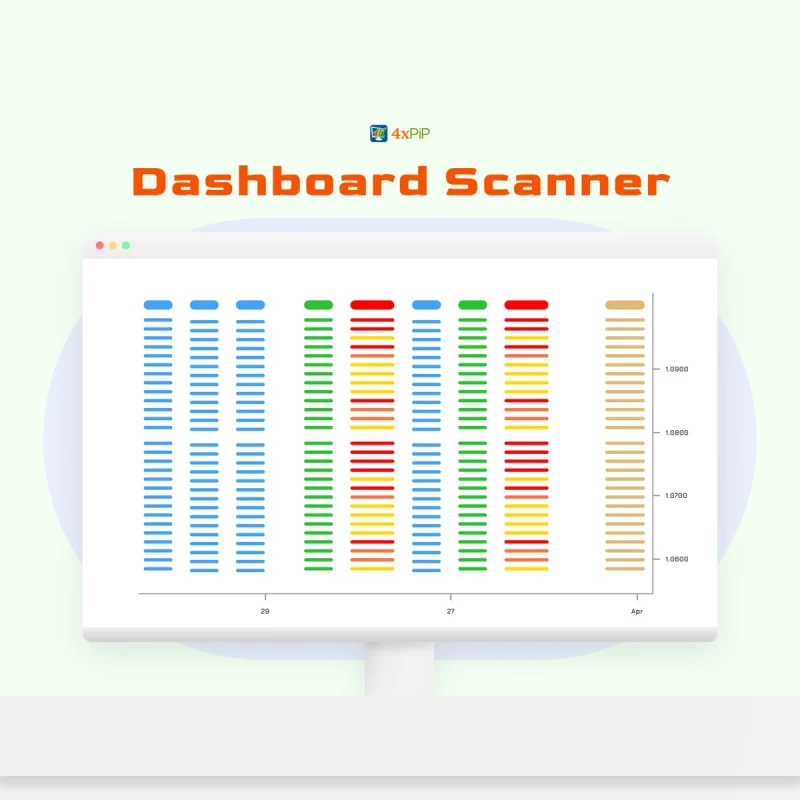

The User interface (UI) is the graphical interface through which traders interact with the platform. It includes features such as price charts, trade execution buttons, and account management tools. A well-designed UI is natural and user-friendly, allowing traders to navigate the platform with ease and makes the platform more user friendly.

Market Data Feed:

A reliable market data feed is very important for accurate decision-making in forex trading. Trading platforms typically provide real-time price quotes, news updates, and other relevant market information to help traders stay informed about market conditions.

Order Management System:

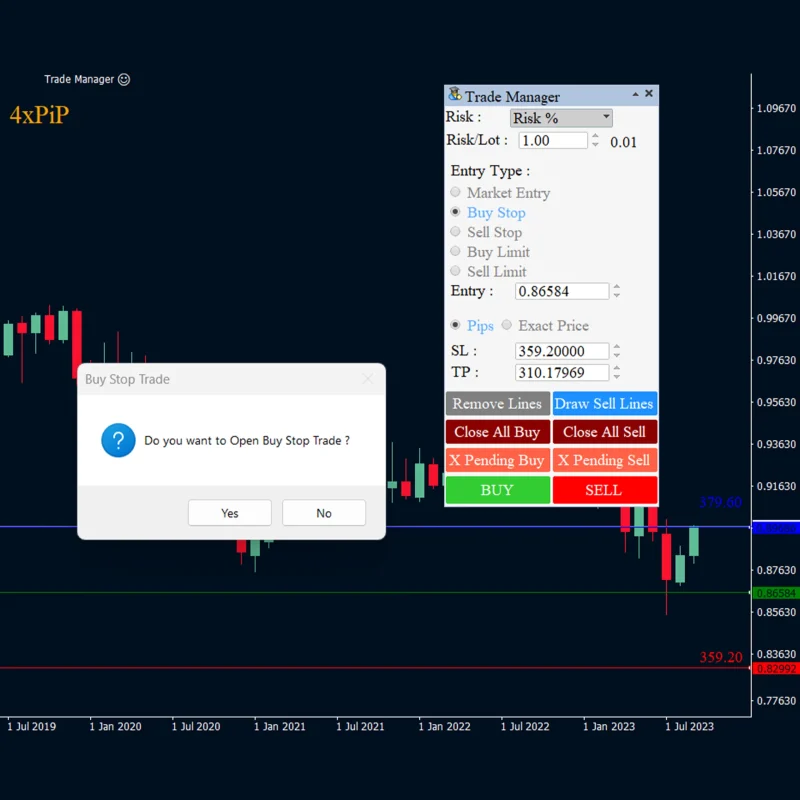

The order management system allows traders to place, modify, and cancel trades. It includes features such as order entry forms, trade execution algorithms, and order status tracking.

Risk Management Tools:

Managing risk is a crucial aspect of successful trading. Trading platforms often include risk management tools such as stop-loss orders, take-profit orders, and margin calculators to help traders mitigate potential losses and protect their capital.

Account Management:

A trading platform must have a good account management. That means users should be able to deposit and withdraw funds securely using various payment methods offered by the platform, monitor their account balance, equity, and profit or loss (P/L) in real-time to stay informed about their financial performance. Forex trading often involves leverage, allowing you to control larger positions with a smaller initial investment. Platforms provide tools to monitor your margin usage and prevent potential margin calls.

Understanding Automated Trading:

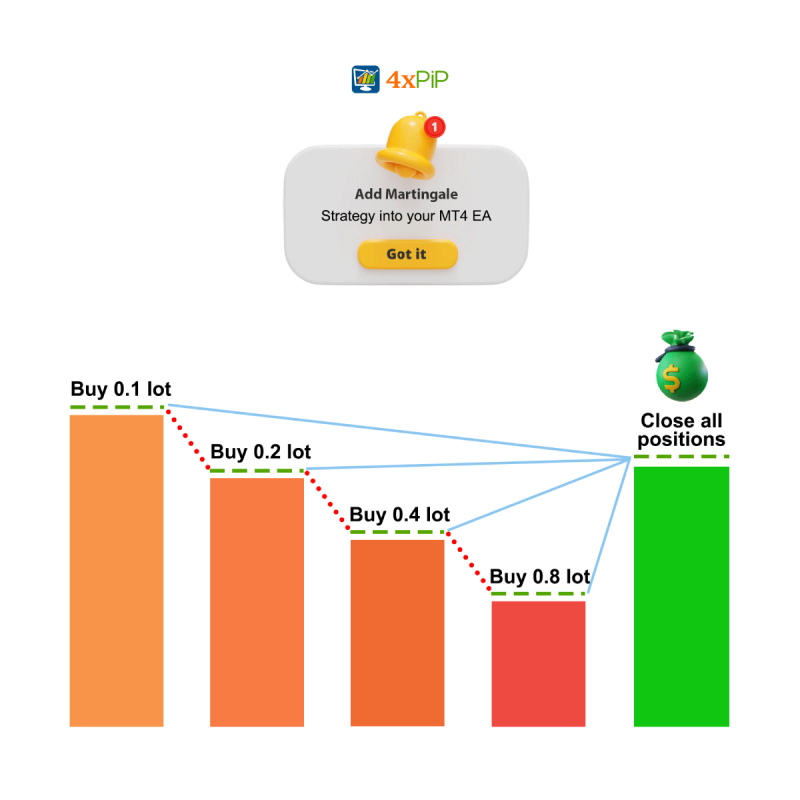

Almost all of the trading platforms have automated trading. Automated trading, also known as algorithmic or black-box trading, utilizes computer programs to automatically make trading decisions. These programs analyze market data, identify trading opportunities, and execute trades according to predefined rules. The benefit of automated trading is that it eliminates human emotions from trading and makes trades quickly and accurately.

To stay ahead of the other traders and to keep yourself relevant to the advancing technology it is very important to learn about the automated trading. We have experienced programmers and developers that can program custom trading bots for traders and for various trading platforms. These Custom Bots allow traders to trade automatically according to their desired instructions which can be given to the custom bots. We have more than 7 years of experienced and have worked with 900+ clients across the globe.

The Future of Forex Trading Platform Programming:

As technology continues to advance, the future of forex trading platform programming holds exciting possibilities. Artificial intelligence (AI) and machine learning algorithms are increasingly being integrated into trading platforms, allowing more sophisticated analysis of market data and predictive modeling of price movements.

Furthermore, the rise of blockchain technology has the potential to revolutionize the forex market by providing a transparent and decentralized infrastructure for trading and settlement. Cryptocurrency-based forex trading platforms are already emerging, offering traders the opportunity to trade forex pairs denominated in digital currencies.

Summary:

Forex trading platforms have evolved significantly over time, thereby offering traders various tools and features to enhance their trading experience. Key components include the user interface, market data feed, order management system, risk management tools, and account management. Automated trading, driven by algorithms, is becoming increasingly popular, eliminating human emotions from trading decisions. As technology advances, the future of forex trading platforms holds exciting possibilities, with the integration of artificial intelligence, machine learning, and blockchain technology. For further questions, contact us at [email protected].

FAQs

What is a forex trading platform?

A forex trading platform is software that allows traders to access the forex market and execute trades. It provides essential tools and features for analyzing the market and managing trades.

How does the user interface impact trading?

A well-designed user interface enhances the trading experience by providing easy navigation and access to essential features like price charts, trade execution buttons, and account management tools.

Why is a reliable market data feed crucial?

Accurate market data feeds ensure traders have up-to-date information for making informed trading decisions, including real-time price quotes and news updates.

What is an order management system?

The order management system allows traders to place, modify, and cancel trades. Additionally, it includes features such as order entry forms, trade execution algorithms, and order status tracking.

How do risk management tools help traders?

Risk management tools such as stop-loss orders, take-profit orders, and margin calculators help traders mitigate potential losses and protect their capital while trading.

What functionalities should a good account management system offer?

A good account management system should enable users to securely deposit and withdraw funds. Moreover, it should allow them to monitor account balances, equity, and profit or loss in real-time, as well as manage leverage effectively.

What is automated trading?

Automated trading, also known as algorithmic or black-box trading, uses computer programs to automatically execute trades based on pre-defined rules and market analysis.

How does automated trading benefit traders?

Automated trading eliminates human emotions from trading decisions. Consequently, it allows for quicker and more accurate trade execution based on market data and predefined strategies.

Can custom trading bots be programmed for different platforms?

Yes, experienced programmers can develop custom trading bots tailored to specific trading platforms. Consequently, this allows traders to automate their trading strategies effectively.

What technologies are shaping the future of forex trading platforms?

Technologies like artificial intelligence, machine learning, and blockchain are expected to revolutionize forex trading platforms. Consequently, they will offer more sophisticated analysis and additionally decentralized trading opportunities.