In the dynamic world of forex trading, one strategy that stands out for its unique approach is Grid Trading. At 4xPip, we believe that understanding this strategy can open new avenues for both unfamiliar and experienced traders. For further guidance, reach out to our experts at [email protected].

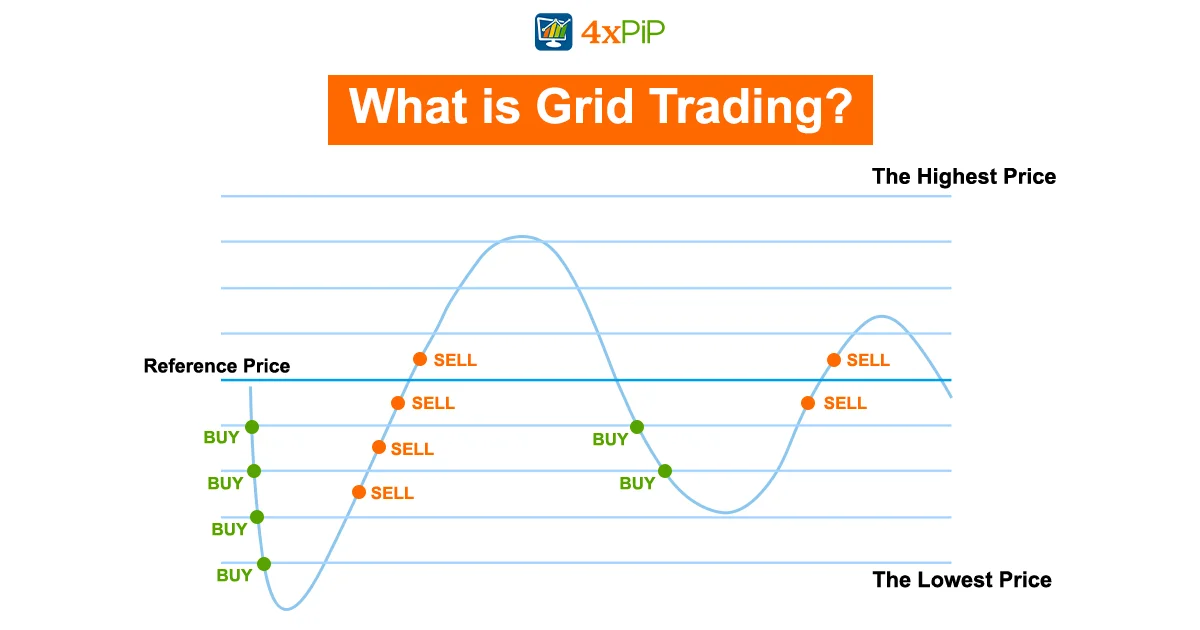

What is Grid Trading?

Grid trading is a strategy that aims to make money when the market goes up and down in a certain range. When prices are moving back and forth within specific levels, grid trading can be a smart way to take advantage of this.

Here’s how it works: You place buy and sell orders at regular intervals or specific price points. Each order has set levels for when to take profits and when to stop losses. This strategy is designed to benefit from the market’s movements within the established range. So, no matter if the market goes up or down, the grid orders are activated, making it possible to earn profits with each completed order.

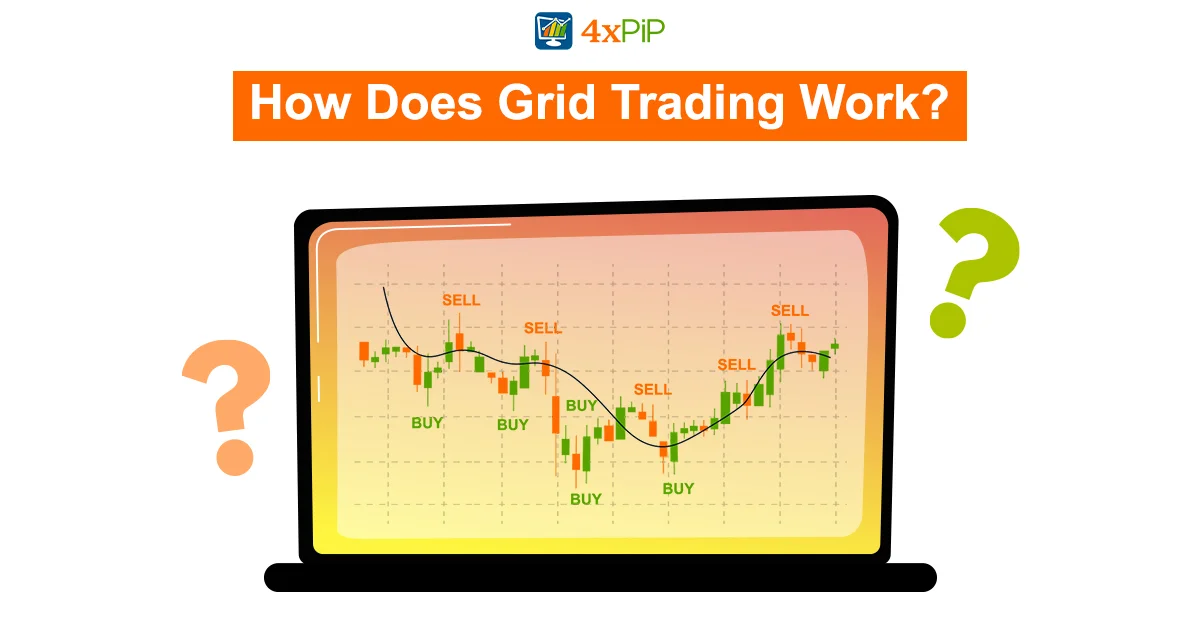

How Does Grid Trading Work?

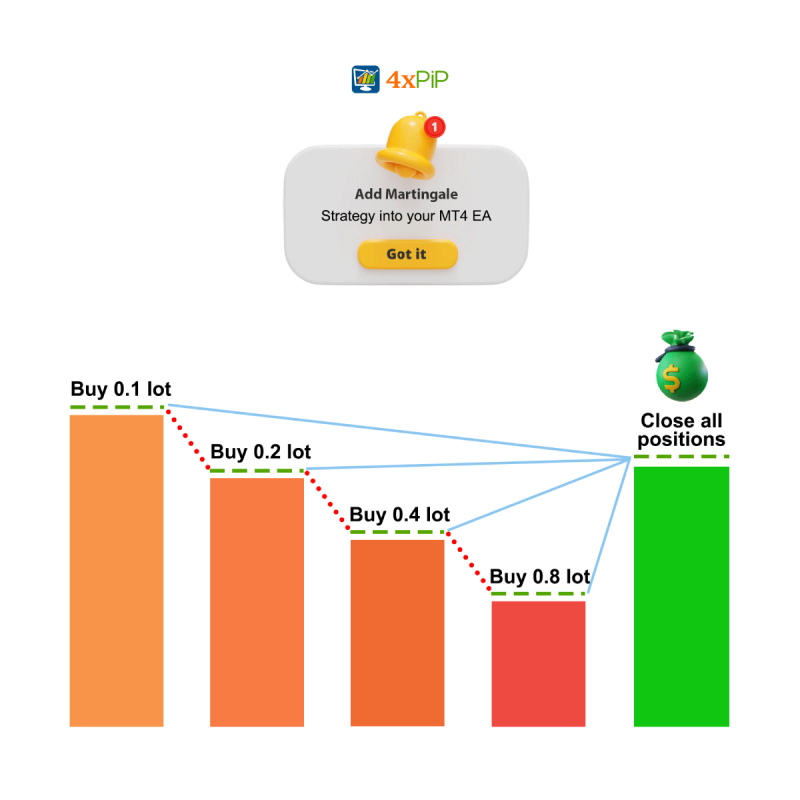

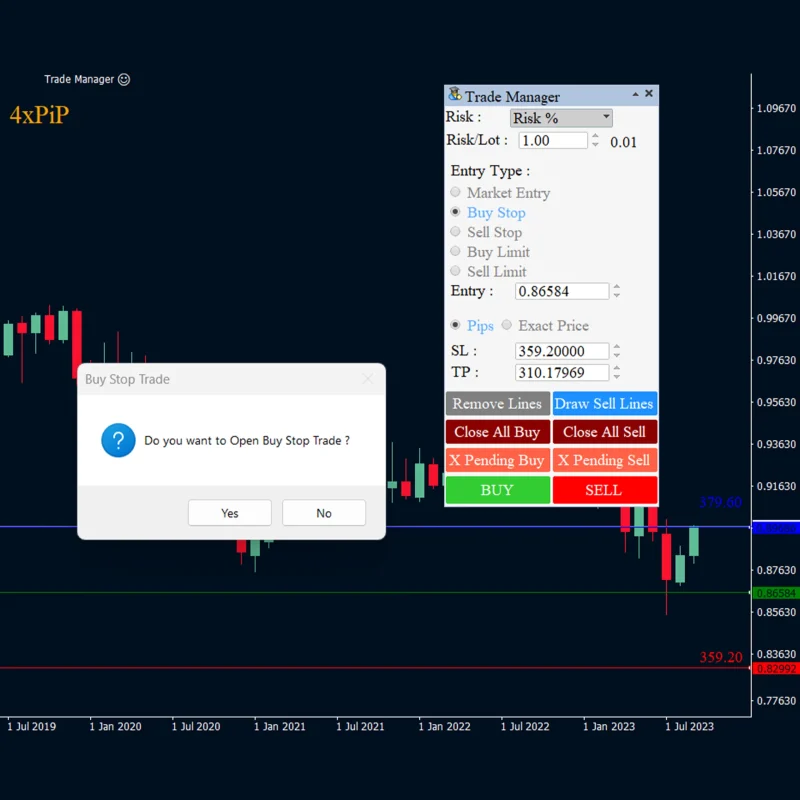

Grid trading is a flexible strategy with two ways to use it: doing it yourself or using automated systems or bots. Most people prefer automation, but it’s important to be careful, especially if you’re not experienced. You need to keep an eye on things to avoid unexpected problems that might come up during automated trading. If you’re trying automation, make sure you’re good at keeping track of it, so the strategy works well in the always-changing world of forex.

Pros and Cons of Grid Trading

Pros:

Grid trading works well in markets that move sideways or stay within a certain range. It can make money even when other strategies might not do so well. The method is simple, reducing the chances of making mistakes, and traders can take advantage of market ups and downs without needing to guess where prices will go. Using automation not only saves time but also allows traders to handle different markets at the same time.

Cons:

Achieving success in grid trading requires being disciplined and patient, as profits grow slowly. Since grid trading doesn’t need a lot of active involvement from the trader, it can sometimes become boring. It’s not a good choice for markets that are trending, where sudden price changes make it tough to close trades with a profit.

How to Implement a Grid Trading Strategy

Choose a Suitable Currency Pair and Time Frame:

Select a currency pair and time frame aligning with your grid trading objectives.

Define Grid Orders and Levels:

Set the range or price levels for grid orders, incorporating take-profit and stop-loss levels.

Place and Monitor Grid Orders:

Execute grid orders and vigilantly monitor the market for movement within the defined range.

Adapt to Changing Conditions:

Adjust grid orders as needed to accommodate evolving market conditions.

Risk Management Strategies in Grid Trading

Effective risk management is paramount in grid trading due to its significant winning percentage but potential for substantial losses.

Maximum Risk Exposure:

Establish a maximum risk exposure for each trade, ensuring it doesn’t exceed a predetermined percentage of the trading account balance.

Stop-Loss Orders:

Implement stop-loss orders to limit potential losses, especially when the market transitions from a range to a trending phase.

Position-Sizing:

Consider using position sizing to cap the size of each grid order, preventing the total size of open orders from exceeding the trading account balance.

Conclusion:

While grid trading offers profit potential in ranging markets, it demands discipline, patience, and exacting risk management. Traders of all levels can explore this strategy by grasping its fundamental principles and integrating a robust risk management plan. For further insights and assistance, connect with our experts at [email protected].

FAQ’s

What is Grid Trading?

Grid trading is a forex strategy involving buy and sell orders at fixed intervals to profit from market volatility within a defined range.

How does Grid Trading work?

It works by placing orders at fixed price levels with predetermined take-profit and stop-loss levels, capitalizing on market oscillations.

Can Grid Trading be automated?

Yes, it can be automated using trading systems or bots, but it requires experienced monitoring to address potential challenges.

Why is Grid Trading profitable in ranging markets?

Grid trading thrives in range-bound markets, where prices move within specific levels, allowing for multiple order triggers and profits.

What are the Pros of Grid Trading?

It’s profitable in ranging markets, easy to understand, and automation saves time, enabling multitasking across different markets.

What are the Cons of Grid Trading?

Requires discipline and patience, profits accumulate slowly, and it’s unsuitable for trending markets due to challenges in exiting trades.

How to implement a Grid Trading strategy?

Choose a suitable currency pair, set grid orders and levels, place and monitor orders, and adapt to changing market conditions.

Why is Risk Management crucial in Grid Trading?

While grid trading has a high winning percentage, losses can be significant, making effective risk management essential.

What is Maximum Risk Exposure in Grid Trading?

It’s setting a maximum risk for each trade to ensure total risk exposure doesn’t exceed a set percentage of the trading account balance.

Why use Stop-Loss Orders in Grid Trading?

Stop-loss orders limit potential losses, crucial when the market transitions from ranging to trending, preventing quick and significant losses.