In this article, 4xPip will discuss hedging in detail. The frequently asked questions like what is hedging? How does it work? Is it helpful? These are all answered in this article. 4xPip also provides information about trading and its risk along with risk mitigation strategies. Do check other articles, 4xPip has written for its readers, through this link.

Financial Hedging: Beginner’s Guide for Hedging:

Hedging is a risk management strategy that traders use to reduce the risk of losses in their portfolios. It involves taking an opposite position in a related asset to offset the losses in the original asset. For example, an investor who owns shares of a company that is exposed to currency risk might hedge their position by buying currency futures contracts. If the value of the currency falls, the losses on the shares will be offset by the gains on the futures contracts.

It can be an effective way to reduce risk, but it also comes with a cost. The investor will have to pay a premium for the protection that hedging provides. Hedging strategies typically involve derivatives, such as options and futures contracts. Derivatives are financial instruments that derive their value from an underlying asset, such as a stock, bond, or currency.

Options give the holder the right, but not the obligation, to buy or sell an asset at a specified price on or before a specified date. Futures contracts are agreements to buy or sell an asset at a specified price on a specified date.Hedging can be a complex topic, but it is an important tool that investors can use to manage their risk. If you are considering hedging your portfolio, it is important to consult with a financial advisor/investor to understand the risks and benefits involved.

What is Hedging?

Hedging is a way for investors to protect their portfolios from losses by using financial instruments to offset potential losses. It involves taking an opposite position in a related asset to offset the losses in the original asset.

Hedging as insurance:

A good way to understand hedging is to think of it as a form of insurance. When people decide to hedge, they are essentially insuring themselves against a negative event that could impact their finances. Just like insurance, hedging doesn’t prevent negative events from happening.

For example, if you buy homeowner’s insurance, you are hedging yourself against the risk of your house burning down. If your house does burn down, the insurance company will pay for the damages, which will help to protect you financially.

Hedging in financial markets:

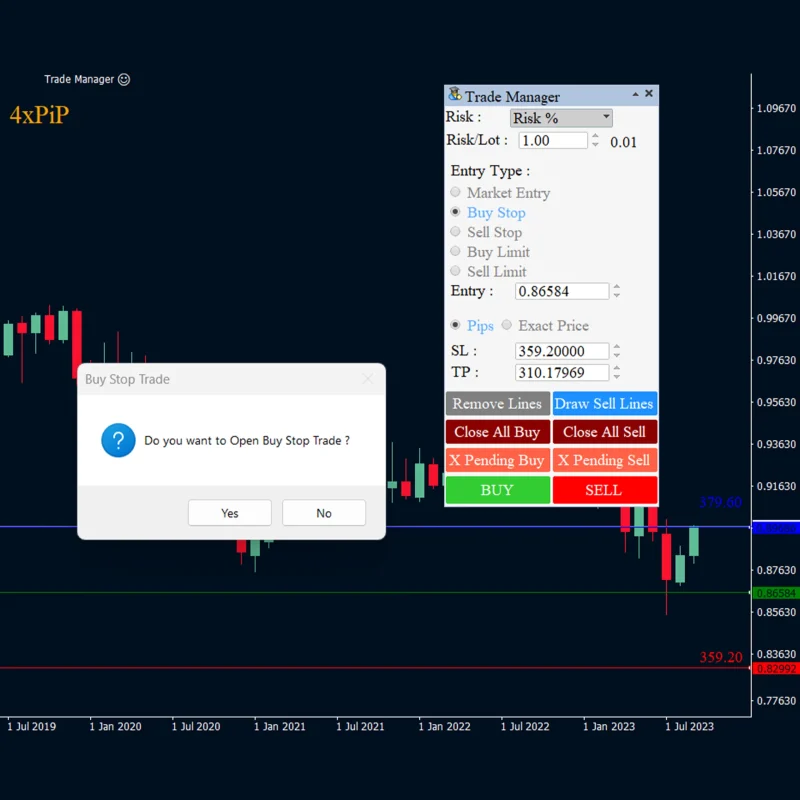

In financial markets, hedging is not as simple as paying an insurance company a fee every year for coverage. Instead, traders use a variety of financial instruments to hedge against risk. Some common hedging instruments include:

- Options: Options give the holder the right, but not the obligation, to buy or sell an asset at a specified price on or before a specified date.

- Futures contracts: Futures contracts are agreements to buy or sell an asset at a specified price on a specified date.

- Forward contracts: Forward contracts are like futures contracts, but they are not traded on an exchange.

- Swaps: Swaps are agreements to exchange cash flows between two parties.

Advantages of Hedging:

Hedging is a risk management strategy that investors use to reduce their risk of losses by taking positions in assets that are expected to move in the opposite direction of the assets they already own. Some of the advantages of hedging include:

- Reduced risk: Hedging can help reduce the risk of losses in your portfolio by offsetting the losses in one asset with gains in another.

- Protection from adverse market movements: Hedging can help to protect your portfolio from adverse market movements, such as a stock market crash or a currency devaluation.

- Preservation of capital: Hedging can help to preserve your capital in the event of a loss.

However, it is important to note that hedging also comes with some risks, such as the cost of hedging and the potential for losses if the hedge is not successful.

Disadvantages of Hedging:

Every hedging strategy has a cost associated with it. The cost of hedging can be seen as the price of insurance. When you buy insurance, you are paying a premium to protect yourself from a potential loss. The same is true with hedging. You are paying a premium to protect your portfolio from losses.

The cost of hedging will vary depending on the type of strategy you use and the level of risk you are trying to hedge. For example, options are a popular hedging instrument, but they can be expensive. Futures contracts are another popular hedger instrument, but they can also be expensive.

- Cost: Hedging can be expensive. The cost of hedging will depend on the type of hedging instrument used and the level of risk being hedged.

- Reduced potential returns: Hedging can reduce your potential returns. This is because the hedge will offset some of the gains in your portfolio, as well as the losses.

- Complexity: Hedging can be complex and difficult to understand. This is especially true for complex hedging strategies.

- Ineffectiveness: The hedge may not be effective in protecting your portfolio from losses. This is because the market can move in unexpected ways.

Example of a Forward Hedge:

A classic example of hedge involves a wheat farmer and the wheat futures market. The wheat farmer plants their seeds in the spring and sells their harvest in the fall. In the intervening months, the farmer is subject to the price risk that wheat will be lower in the fall than it is now. The farmer wants to make as much money as possible from their harvest, but they also don’t want to speculate on the price of wheat.

To hedge against this risk, the farmer can sell a six-month futures contract at the current price of $35 a bushel. This is known as a forward hedge.

A futures contract is a legally binding agreement to buy or sell an asset at a specified price on a specified date. In this case, the farmer is agreeing to sell wheat at $35 a bushel in six months. If the market price of wheat falls below $35 in six months, the farmer will still be able to sell their wheat for $35. This is because they have already sold the futures contract. On the other hand, if the market price of wheat rises above $35 in six months, the farmer will have missed out on some potential profits. However, they will still be able to sell their wheat at the agreed-upon price of $35.

Protective Put Hedging: How to Use Protective Puts to Limit Downside Losses:

A protective put is a hedging strategy that can be used to limit downside losses on an investment. It involves buying a put option on the underlying asset, which gives the investor the right, but not the obligation, to sell the asset at a specified price (the strike price) on or before a specified date.

For example, let’s say you own 100 shares of XYZ stock, which is currently trading at $100 per share. You are concerned about the stock market’s volatility and want to protect yourself from a 10% loss. You could buy a 90-strike put option on XYZ stock. This option would give you the right to sell your shares at $90 per share at any time before the option expires.

If the stock market does decline by 10% or more, and the price of XYZ stocks falls to $90 or below, you can exercise your put option and sell your shares at $90 per share. This stock market would limit your losses to $10 per share.

Delta Hedging: How to Use Delta to Reduce Risk in Options Trading:

Delta is a risk measure used in options trading that measures the sensitivity of an option’s price to changes in the price of the underlying asset. It is a numeric value between 0 and 1, with 0 meaning that the option price does not change with the price of the underlying asset and 1 meaning that the option price moves perfectly with the price of the underlying asset.

For example, if you buy a call option with a delta of 0.5, its price will increase by $0.50 if the underlying asset price increases by $1.00. Conversely, if the underlying asset price decreases by $1.00, the option price will decrease by $0.50.

Delta hedging is a useful tool for trades. For example, if you are long a call option, you can hedge your position by selling shares of the underlying asset. The number of shares you sell should be equal to the delta of the option. This will create a delta-neutral position, meaning that your overall position will not be affected by changes in the price of the underlying asset.

What’s a Commercial Hedger?

A commercial hedger is a company or producer that uses derivatives markets to reduce their risk exposure to price fluctuations in the commodities they use or produce. For example, a corn farmer may sell corn futures contracts to hedge against the risk of the price of corn falling before they harvest their crop. Similarly, a cereal manufacturer like Kellogg’s may buy corn futures contracts to hedge against the risk of the price of corn rising, which would increase their production costs.

Derivatives are financial instruments that derive their value from an underlying asset, such as a commodity, currency, or stock. Futures contracts are a type of derivative that obligates the buyer to buy an asset at a specified price on a specified date.

Commercial hedgers use derivatives to lock in a price for an asset, such as corn, at a future date. This can help them to protect themselves from losses if the price of the asset falls.

What Is De-Hedging?

De-hedging is the process of closing out an existing hedge position. This can be done for a number of reasons, such as:

- The hedge is no longer needed. For example, if the price of the underlying asset has moved in the desired direction, the hedge may no longer be necessary.

- The cost of the hedge is too high. The cost of hedging can fluctuate over time, and if the cost becomes too high, it may be worthwhile to de-hedge.

- The investor wants to take on more risk. Hedging can reduce risk, but it can also reduce returns. If the investor is willing to take on more risk, they may choose to de-hedge.

Summary:

Hedging is a risk management strategy that investors use to reduce the risk of losses in their portfolios. It involves taking an opposite position in a related asset to offset the losses in the original asset. Hedging is similar to insurance. Just like insurance, hedging doesn’t prevent negative events from happening. However, if a negative event does happen and you’re properly hedged, the impact of the event is reduced. There are many different hedging strategies, but some of the most common include options, futures, and forward contracts.

Hedging can be a complex topic, but it is an important tool that investors can use to manage their risk. If you are considering hedging your portfolio, it is important to consult with a financial advisor to understand the risks and benefits involved.