The stop-loss order is a trading order that automatically sells security when it reaches a specified price, called the stop price. This is done to limit the trader’s loss on the position.

Traders of all experience levels commonly use stop-loss orders as a popular risk management tool. They utilize them to either safeguard profits on existing positions or restrict losses on new positions.

In this article, 4xPip will discuss the importance of a stop-loss along with different methods and places to set it to minimize losses.

Stop-Loss Order:

A stop-loss order is a market order to sell a security when it reaches a specific price. This helps traders limit their losses on a security position. For example, if a trader buys a stock for $25 per share and places a stop-loss order at $22.50, their loss will be limited to 10%. If the stock drops below $22.50, the trader’s shares will be sold at the current market price.

Types of Stop-Loss:

There are two types of stop-loss orders available in the stock market and these are trailing stop-loss and fixed stop-loss.

The Fixed stop-loss does not trail the stop-loss along with the price; it stays at the same position where you originally set it.

This ensures that you capture the lowest loss in unpredictable markets. The Trailing stop loss trails Stoploss along with the price, generating high profits and providing an optimum exit point. It helps you to catch the highest pips in the unpredictable markets.

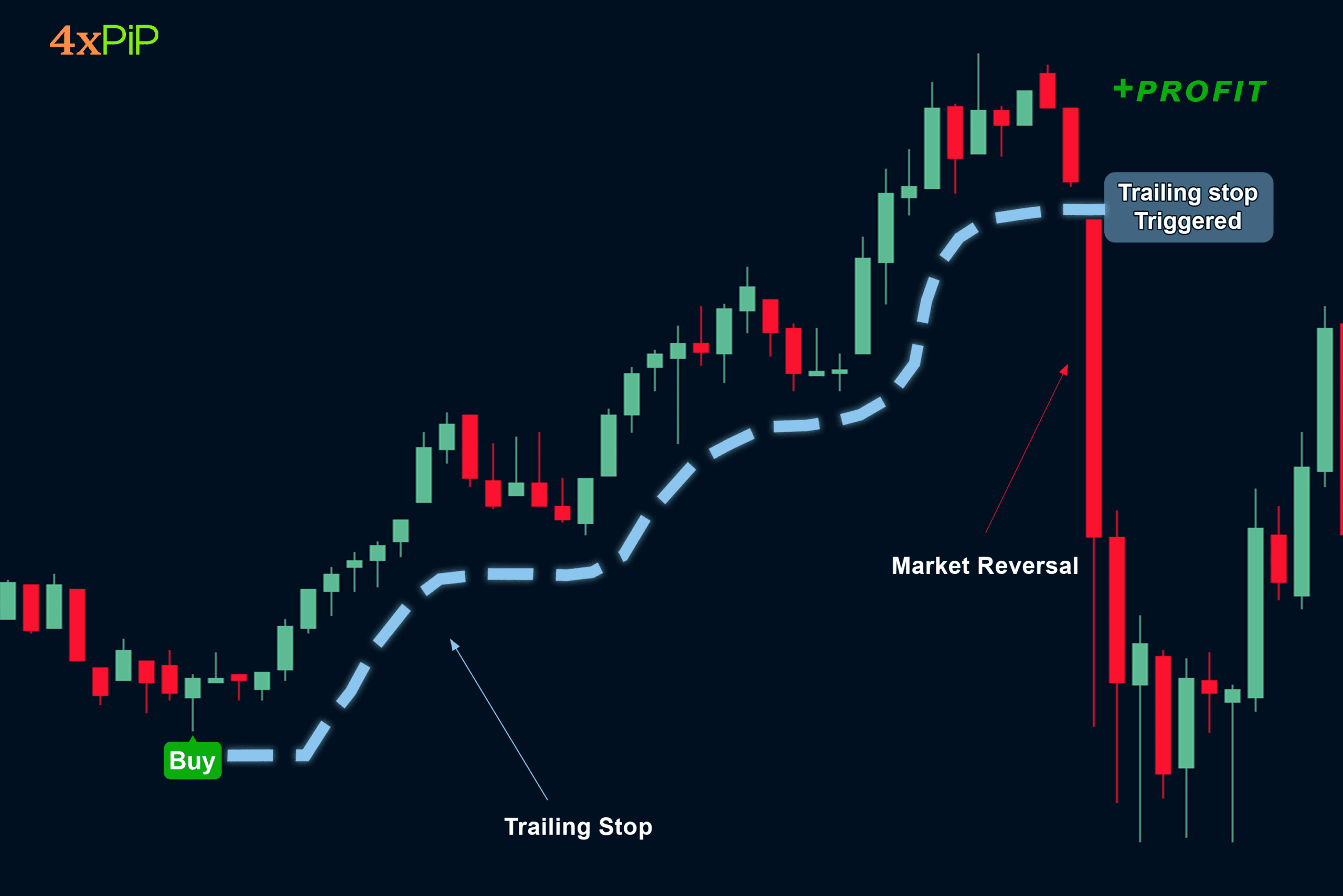

Trailing Stop-Loss:

It is a way to initially set a normal stop-loss but later on, it trails the stop-loss along with the price. The stop-loss has no fixed value, it keeps trailing along with the price in the direction of the market. There is even no need to set a fixed takeprofit in the presence of a trailing stop-loss. The trailing stop-loss closes the trades at the market reversal. So, whenever the market is going to reverse, that’s the stop-loss. It’s a very powerful dynamic stop-loss that exits the trades gaining the highest available profits.

Trailing stop-loss is a rapid and intricate strategy that one should only execute through auto-trading, not manual trading, as auto-trading Expert Advisors swiftly adjust the stop-loss.

4xPip has one of the best trailing stop-loss products. Do check them out at MT5 Trailing Stop EA and MT4 Trailing Stop EA.

Click here to download MT4 Trailing Stop EA:

Click here to download MT5 Trailing Stop EA:

How to Determine Stop-Loss Order?

The goal of placing stop-loss orders is to limit losses on trades. Traders achieve this by placing a stop-loss order at a specific price or by using a trailing stop-loss order, which automatically moves the stop-loss order up as the price of the security rises.

Technical traders often use stop-loss orders to time the market. There are many different theories about where to place stop-loss orders, but some common methods include using universal placements (such as a 6% trailing stop on all securities) or security- or pattern-specific placements (such as average true-range percentage stops).

Methods:

Methods:

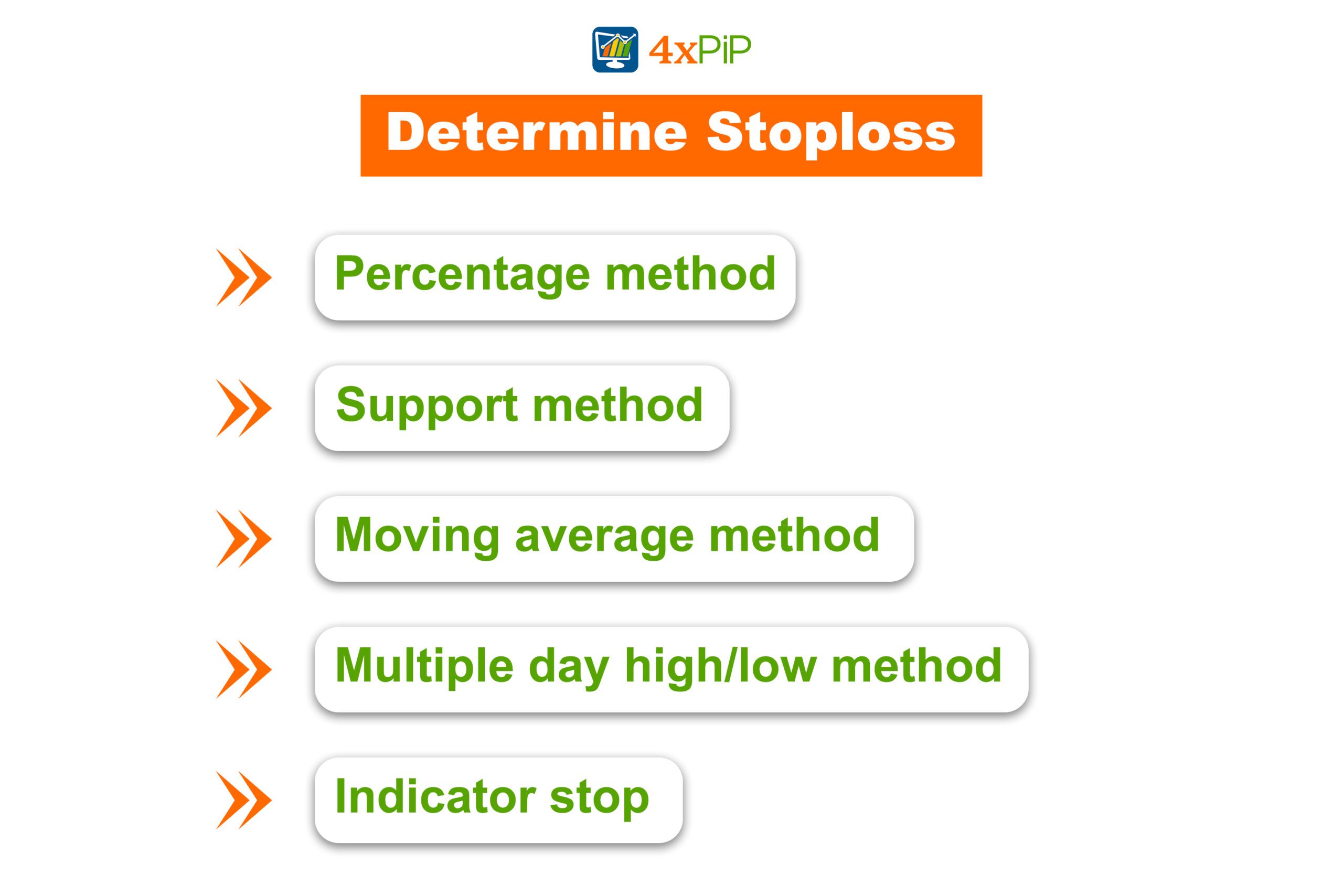

Common stop-loss placement methods include:

- Percentage method: Place a stop-loss order at a specific percentage below the purchase price.

- Support method: Place a stop-loss order just below a recent support level.

- Moving average method: Place a stop-loss order just below a longer-term moving average price.

- Multiple-day high/low method: Place a stop-loss order at the low price of a predetermined day’s trading.

- Indicator stops: Place a stop-loss order based on a technical indicator, such as the relative strength index (RSI).

Swing traders often use the multiple-day high/low method, while more patient traders may use indicator stops.

Where Should the Stop-Loss Be Set?

Stop-loss orders are essential for limiting losses in trading, but it can be difficult to determine where to set them. Setting them too far away can result in big losses while setting them too close can lead to exiting positions too quickly.

Stop-loss orders are essential for traders to limit potential losses. The choice of where to set the stop-loss depends on risk tolerance. Three common methods include the percentage method, which uses a specific percentage below the current price, the support method, which places it just below the recent support level, and the moving average method, positioning it below a longer-term moving average price.

Considerations With Stop-Loss Orders:

- Stop-loss orders are not ideal for traders who buy and sell stocks frequently.

- Stop-loss orders are not effective for large quantities of stocks, as you may lose more money in the long run.

- Different brokers charge different fees for different types of orders, so be aware of how much you are paying.

- Do not assume that your stop-loss order has been executed. Always wait for the order confirmation.

Traders should consider their risk tolerance and market volatility when placing stop-loss orders. Securities that are prone to retracements require a more active stop-loss strategy. Stop-loss orders are a method for risk management, but they do not guarantee profits.

Conclusion:

A stop-loss order is a trading order that automatically sells a security when it reaches a specified price, known as the stop price. Traders use this order to limit their loss on the position. Setting stop-loss orders involves various methods, with some common ones being the percentage method, the support method, and the moving average method. When placing stop-loss orders, it’s essential to consider your risk tolerance and market volatility. Securities that often experience retracements necessitate a more active stop-loss strategy. Stop-loss orders serve as a valuable tool for risk management, but they do not guarantee profits.