In the dynamic world of trading, mastering the art of stop-loss placement is as crucial as knowing when to enter or exit for optimal profits. In this extensive guide, 4xPip is here to provide you with valuable insights into the intricate process of setting stop losses using Fibonacci levels. Whether you’re a beginner or an experienced trader, understanding these techniques is paramount for effective risk management. Explore the world of trading with 4xPip, your go-to source for expert guidance and top-notch trading tools at 4xpip, or contact our experts at [email protected].

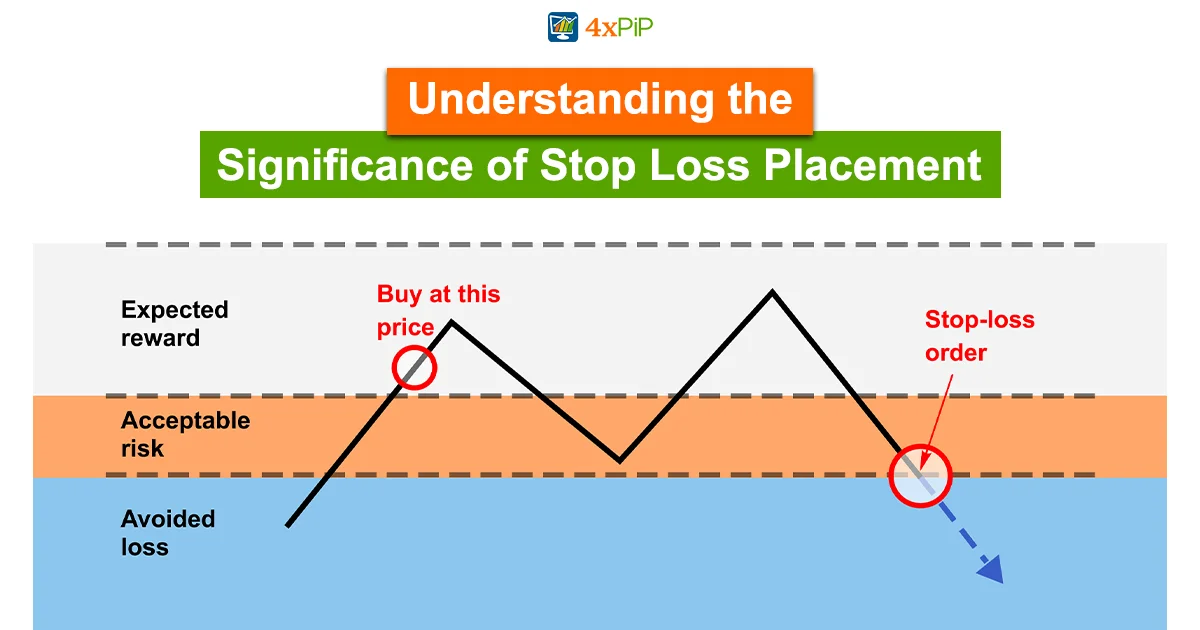

Understanding the Significance of Stop Loss Placement:

Setting stop losses is more than just a precautionary measure; it’s a strategic move to safeguard your investments. Neglecting this crucial step can result in substantial losses, and traders often find themselves pointing fingers at Fibonacci. In reality, success lies in mastering the precise placement of stop losses.

Method #1: Placing Stop Just Past Next Fibonacci Level:

A Beginner’s Guide to Fibonacci Dynamics:

For novice traders, the first method involves setting your stop just beyond the next Fibonacci level. Suppose you plan to enter at the 38.2% Fib level; in that case, position your stop slightly past the 50.0% level. The simplicity of this approach is evident, but it demands confidence in predicting support or resistance areas.

Navigating Challenges in Stop Loss Placement:

An ideal entry is crucial for this method to work effectively. Depending solely on drawing tools may lead to hitting stops before the market moves favorably. While suitable for short-term, intraday trades, exercising caution and quick loss limitation are essential.

Method #2: Placing Stop Past Recent Swing High/Low:

Balancing Safety and Trade Flexibility:

A more conservative approach involves placing stops beyond the recent Swing High or Swing Low. Moreover, in an uptrend, position the stop just below the latest Swing Low, acting as a potential support level. Alternatively, in a downtrend, set the stop just above the Swing High, a potential resistance level.

Trade Dynamics with Larger Stop Losses:

This method provides trades with more breathing room, offering a higher probability of the market moving favorably. Larger stop losses are suitable for longer-term, swing-type trades, especially when incorporated into a “scaling in” method. Remember to adjust position size to mitigate potential losses.

Measurement of Stop Loss and Take Profit Levels Based on Fibonacci:

Precision in Fibonacci Dynamics:

Apart from placement, precision in measurement is crucial. Furthermore, understanding the Fibonacci retracement tool for determining stop loss and take profit levels adds a layer of sophistication to your strategy. Each Fib level holds significance, providing a roadmap for strategic decision-making.

Strategic Decision-Making for Effective Trading:

By incorporating Fibonacci levels into your stop loss and taking profit measurements, you enhance your ability to make strategic decisions. Additionally, this method ensures that your trades align with market trends, maximizing the profit potential. Moreover, it helps in minimizing unnecessary risks associated with the volatile nature of the market.

Choosing the Optimal Stop Loss Placement:

Harmonizing Tools for Precision:

Similar to combining various tools for a better entry, choosing the optimal stop loss placement involves harmonizing Fibonacci with support, resistance, trend lines, and candlesticks. Additionally, relying solely on Fibonacci levels for stop loss points is not recommended; a holistic approach increases the odds of a successful trade.

Risk Mitigation and Reward Optimization:

Stop loss placement is not foolproof, but combining tools can tilt the odds in your favor, leading to a better exit point, increased trade room, and improved reward-to-risk ratios. At 4xPip, we emphasize the importance of a comprehensive approach to risk mitigation and reward optimization.

Conclusion:

Mastering stop-loss placement is an ongoing learning process. At 4xPip, we encourage traders to explore the world of trading with a holistic mindset. For top-notch trading tools and expert guidance, explore our products at 4xpip or reach out to our experts at [email protected]. Trade wisely, mitigate risks, and let your winners run.