Martingale Expert Advisors (EAs) are automated trading bots that increase position size after a losing trade, aiming to recover losses when the market eventually reverses. In forex and CFD trading, this approach is commonly used because it can produce frequent winning cycles, especially during ranging market conditions. On MetaTrader (MT4/MT5), many traders rely on grid-based Martingale strategies where counter trades are opened at predefined pip or point intervals. At 4xPip, we regularly work with traders and EA owners who request custom Martingale logic, including adjustable lot multipliers, grid steps, and centralized take profit models designed to close grouped trades together.

Drawdown is the key risk metric that determines whether a Martingale strategy survives or fails. It measures the peak-to-trough equity decline and reflects how much capital is at risk during extended adverse market moves. While Martingale EAs can appear stable and profitable in the short term, their structural design exposes accounts to compounding drawdown when trends persist longer than expected. In this article, we break down these hidden risks clearly, showing why proper Martingale settings for MT4, capital planning, and risk limits matter, and how traders working with 4xPip can better understand the long-term impact of Martingale behavior on account survival rather than just short-term gains.

How Martingale Expert Advisors Work in Automated Trading

The core Martingale principle is simple: when a trade goes into loss, the next position opens with an increased lot size to recover the previous drawdown once price retraces. In automated trading, this logic is attractive because a single favorable move can close an entire basket of trades in profit. At 4xPip, we implement this concept through grid trading, where counter trades open at predefined steps (pips or points) against the running order. Using controlled Martingale orders and a centralized take profit, the EA is designed to close grouped positions together, which explains why traders often search for optimized or Best Martingale settings for MT4 to balance recovery speed with capital exposure.

Inside an Expert Advisor, this logic is executed through order stacking and lot size multiplication. After the initial trade, each new Martingale order increases the lot size using a multiplier or increment, while grid spacing defines when the next position opens. Our 4xPip Martingale EAs automate this process on MetaTrader by adjusting lot size, recalculating the centralized take profit, and managing multiple open trades as a single profit target. This structure often produces very high win rates because most trade cycles eventually close in profit. However, the risk remains embedded in the growing position size during extended market moves, which is why understanding how these mechanics work is important before relying on headline performance metrics alone.

Understanding Drawdown and Why It Matters for EA Performance

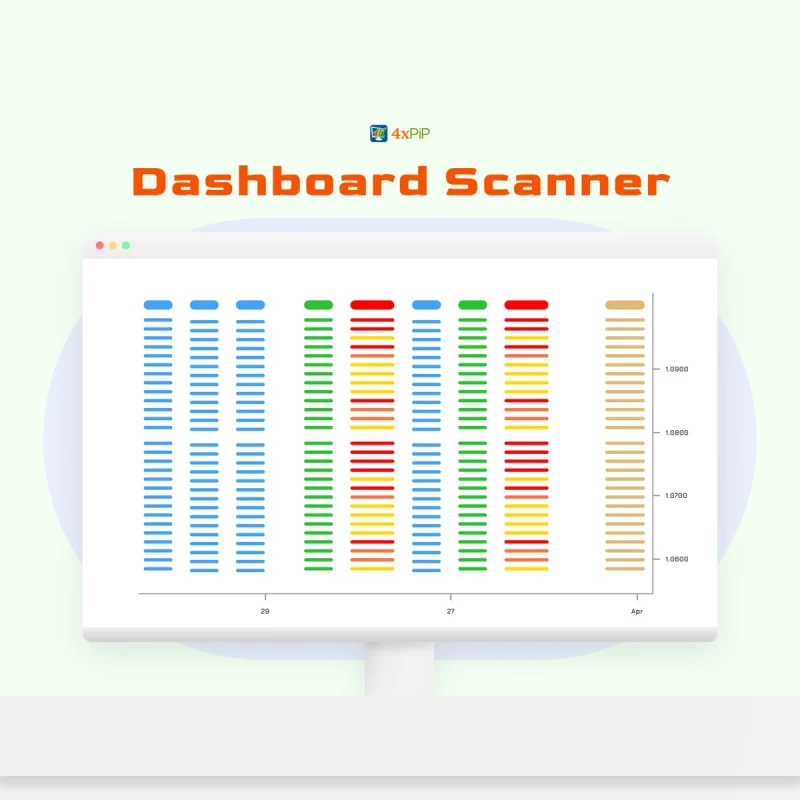

Drawdown represents the decline in account equity from its peak and is one of the most important risk metrics in automated trading. Floating drawdown refers to unrealized losses from open positions, while realized drawdown reflects losses that are already closed and booked into balance. In Martingale-based systems, floating drawdown is especially important because multiple counter trades remain open simultaneously. At 4xPip, our Martingale Strategy Grid EA openly displays running trades and live profit on the chart, allowing traders and EA owners to see how grid spacing, lot multiplier, and Martingale orders directly influence floating drawdown on MetaTrader.

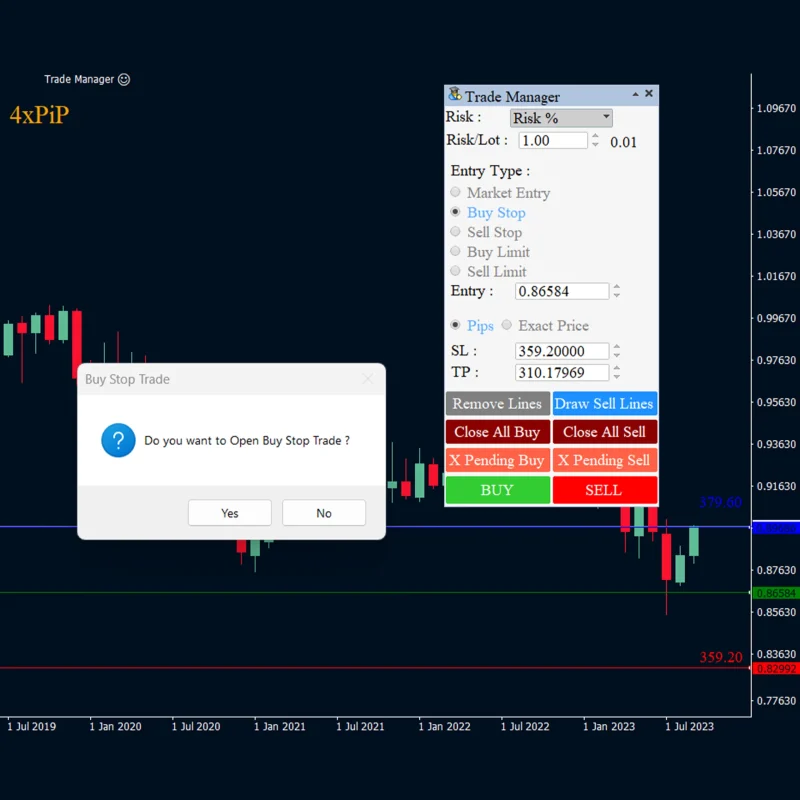

High drawdown impacts more than just numbers, it directly affects margin usage, equity stability, and decision-making under pressure. As drawdown increases, free margin shrinks, limiting the EA’s ability to open recovery trades and increasing the risk of stop-out. This is why profit alone is a misleading metric when evaluating EAs. A system can show a high win rate and still expose the account to unacceptable risk. When configuring Best Martingale settings for MT4 with 4xPip, we emphasize drawdown control through parameters like max Martingale trades, stopout percentage, and centralized take profit, because sustainable performance is defined by controlled risk, not short-term gains.

Hidden Risk of Exponential Position Sizing

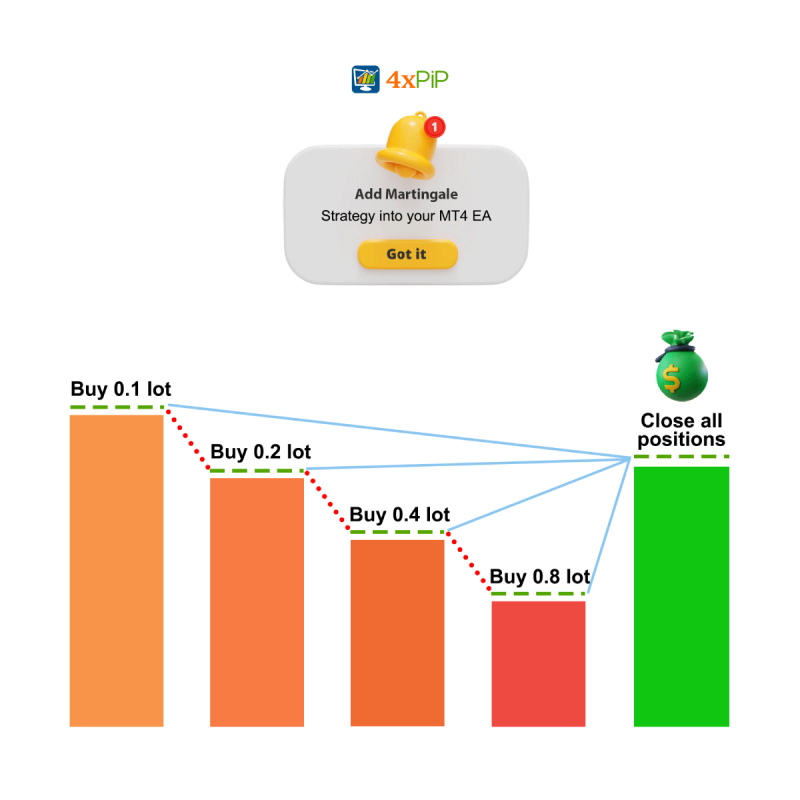

One of the most overlooked dangers of Martingale strategies is exponential position sizing during losing streaks. Even with what appears to be a modest lot multiplier, each new Martingale order increases exposure rapidly as losses extend. For example, a sequence like 0.1 → 0.2 → 0.4 → 0.8 grows faster than most traders anticipate, especially when multiple grid trades remain open. At 4xPip, we see this risk clearly when traders configure Martingale orders, steps, and lot multiplier without fully accounting for how quickly position size escalates across consecutive counter trades on MetaTrader.

This rapid growth means only a few adverse price movements can consume a large portion of account equity and margin. Floating drawdown expands as each new trade opens, reducing free margin and increasing stop-out risk long before the centralized take profit is reached. Backtests often underestimate this exposure because historical data rarely captures extreme volatility, prolonged trends, or news-driven price expansion. When optimizing Best Martingale settings for MT5, we emphasize forward-thinking risk controls, such as max Martingale trades and stopout percentage, because real-market conditions can push exponential sizing far beyond what historical simulations suggest.

Market Conditions That Expose Martingale Drawdown Risks

Strong directional trends, high-impact news events, and volatility spikes are the primary conditions where Martingale drawdown risk becomes visible. In these environments, price does not retrace within normal grid spacing, causing Martingale orders to stack rapidly as counter trades trigger at each defined step. Even with adjustable parameters like Martingale Orders, steps, and lot multiplier, sustained momentum can push floating drawdown higher before the centralized take profit has a chance to realign. This is where understanding Best Martingale settings for MT4 becomes important. At 4xPip, we account for these conditions by allowing EA owners and customers to control max Martingale trades, stopout percentage, and grid distance directly on MetaTrader, ensuring exposure remains measurable rather than uncontrolled.

Ranging markets, on the other hand, favor Martingale EAs because price oscillation allows recovery trades to close as a group in profit, often reinforcing a false sense of safety. This comfort disappears during breakouts or trend continuations, where recovery mechanisms fail to catch reversals and drawdown accelerates quickly. Common scenarios include post-news expansions, session overlaps, or volatility after consolidation, where centralized take profit keeps adjusting but equity pressure intensifies. Our MT4 Martingale trading EA displays running trades, total profit, and EA direction on the chart, making these risk phases visible in real time. From a 4xPip perspective, this transparency helps traders evaluate when Martingale strategy behavior aligns with market structure, and when risk controls must take priority over recovery expectations.

Margin Pressure, Leverage, and Account Wipeout Scenarios

As Martingale orders increase in size, margin requirements rise proportionally because each new position consumes more free margin on MetaTrader. With a lot multiplier applied before every counter trade, exposure grows faster than equity, especially when grid spacing is tight. Even though our Martingale trading EA includes lot size management, Martingale Orders limits, and adjustable steps, margin pressure becomes unavoidable if trade size escalates during extended adverse movement. From a 4xPip standpoint, this is why configuring Best Martingale settings for MT4 starts with conservative initial lot size and realistic max trades, margin is a hard constraint that no recovery mechanism can bypass.

Leverage amplifies this risk during drawdowns by allowing larger positions with less capital, but it also accelerates margin calls and forced liquidation when equity drops. Accounts are often wiped out not because price never reverses, but because margin exhaustion closes trades before recovery occurs. Centralized take profit may still be positioned to close the basket in profit, yet insufficient free margin prevents the EA from sustaining open positions. Our EA displays running trades, profit, and exposure directly on the chart, helping traders and EA owners see margin stress in real time. At 4xPip, we treat margin control as a structural risk factor, not a setting, one that must be managed alongside Martingale distance, stopout percentage, and leverage to avoid irreversible account failure.

Risk Management Limitations in Martingale Expert Advisors

Stop-losses are often avoided in Martingale systems because the core strategy depends on recovery rather than loss acceptance. Fixed stop-loss levels can prematurely close positions that are designed to be offset by counter trades and centralized take profit. In practice, this makes traditional stop-loss logic ineffective once multiple Martingale orders are active. At 4xPip, our MT4 Martingale trading EA instead relies on parameters such as Martingale Orders, steps, lot multiplier, and auto adjustment of SL TP to manage exposure within the grid. However, even with these controls, risk is redistributed rather than eliminated, which is why selecting Best Martingale settings for MT4 requires understanding how recovery mechanisms behave during prolonged adverse movement.

Equity protection features and max-trade caps also have clear limitations. A stopout percentage or max Martingale trades setting can halt further exposure, but it cannot reverse existing floating drawdown once margin pressure builds. When max trades are reached, price may still move against open positions, and equity protection simply locks in losses instead of enabling recovery. From a 4xPip perspective, Martingale EAs should be evaluated on how transparently they expose risk, such as displaying running trades, profit, and EA direction on the chart, rather than on smooth profit curves alone. Realistic expectations, adequate capital, and disciplined risk controls matter more than backtested returns, because Martingale performance is ultimately defined by how loss scenarios are handled, not how profits accumulate during favorable conditions.

Summary

Martingale Expert Advisors are widely used in forex and CFD trading because they can generate frequent winning cycles by increasing position size after losses. However, this same recovery-driven structure introduces significant drawdown risks that are often underestimated. As positions stack through grid-based Martingale logic, exposure grows rapidly during extended trends, placing pressure on equity, margin, and overall account stability. While these systems can appear profitable in short-term results, their long-term survival depends on how well drawdown, margin usage, and adverse market conditions are managed.

This article explains how Martingale EAs function on MT4 and MT5, why drawdown is the most critical performance metric, and which hidden risks can lead to account failure. From exponential position sizing to margin exhaustion and risk management limitations, it highlights why traders must look beyond win rates and profit curves. With practical insights drawn from real-world EA development at 4xPip, the focus remains on transparency, realistic expectations, and configuring Martingale strategies with controlled risk rather than relying on recovery assumptions alone.

4xPip Email Address: [email protected]

4xPip Telegram: https://t.me/pip_4x

4xPip Whatsapp: https://api.whatsapp.com/send/?phone=18382131588

FAQs

- What is a Martingale Expert Advisor in forex trading?

A Martingale Expert Advisor is an automated trading system that increases trade size after a losing position. The goal is to recover previous losses when price retraces, often using grid-based entries and a centralized take profit on platforms like MT4 and MT5. - Why do Martingale EAs often show high win rates?

Martingale systems close multiple trades together once price moves favorably, which results in frequent winning cycles. This structure creates the appearance of consistency, even though risk continues to build during losing streaks. - What is drawdown, and why is it important for Martingale strategies?

Drawdown measures the decline in equity from its peak. In Martingale EAs, floating drawdown is especially important because multiple open trades can accumulate large unrealized losses during extended adverse market moves. - How does exponential position sizing increase risk?

Each Martingale order increases lot size using a multiplier, causing exposure to grow rapidly. Even a few consecutive losing trades can significantly increase margin usage and drawdown beyond what many traders anticipate. - Which market conditions are most dangerous for Martingale EAs?

Strong trends, high-impact news events, and volatility spikes are the most risky. In these conditions, price may not retrace within grid spacing, leading to rapid order stacking and escalating drawdown. - Why do backtests often underestimate Martingale risk?

Historical data rarely captures extreme volatility or prolonged trends accurately. As a result, backtests can make Martingale strategies appear safer than they are under real-market conditions. - How does leverage affect Martingale drawdown and margin pressure?

Higher leverage allows larger positions with less capital, but it also accelerates margin calls during drawdowns. Many accounts fail due to margin exhaustion before price has a chance to reverse. - Why are stop-losses rarely used in Martingale EAs?

Martingale strategies rely on recovery rather than accepting losses. Fixed stop-losses can close trades prematurely, making them ineffective once multiple counter trades are active. - Do equity protection and max-trade limits fully control risk?

These features can limit further exposure, but they cannot reduce existing floating drawdown. Once margin pressure builds, equity protection often locks in losses rather than enabling recovery. - How should traders evaluate Martingale Expert Advisors realistically?

Martingale EAs should be assessed based on drawdown behavior, margin usage, and transparency rather than profit curves alone. Sustainable performance depends on controlled risk, sufficient capital, and a clear understanding of how loss scenarios are handled, an approach emphasized in 4xPip’s EA development philosophy.