Navigating the trading world demands innovative tools. Additionally, Heikin-Ashi, or “average bar” in Japanese, is gaining popularity. Used alongside candlestick charts, it aids in spotting trends and predicting market movements. In this guide, we’ll explore Heikin-Ashi; moreover, we’ll delve into its formula, chart construction, and practical applications for informed decision-making.

Unlocking Heikin-Ashi: A Trend Identifier:

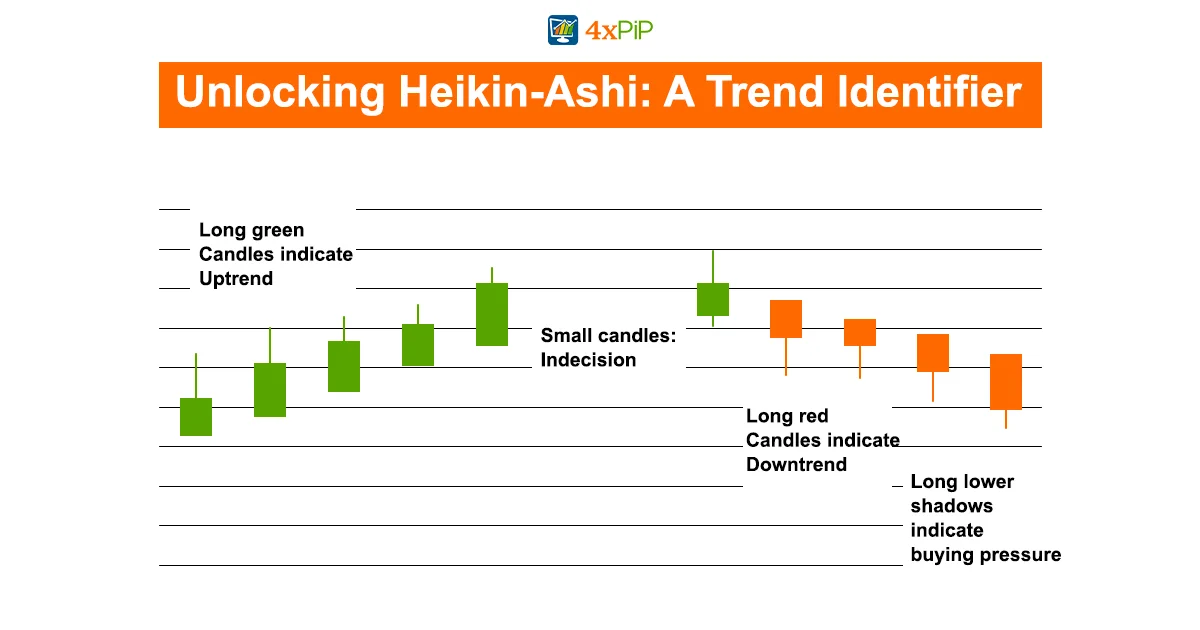

Heikin-Ashi enhances candlestick chart readability; additionally, it helps traders identify trends crucial for maximizing profits. Its unique formula alters the traditional COHL sequence, playing a crucial role in smoothing price movements. Moreover, Heikin-Ashi provides a different perspective on price action.

Deciphering the Formula for Smart Trading:

Heikin-Ashi’s formula involves Close = 1/4(Open + High + Low + Close) and Open = 1/2(Open of Prev. Bar + Close of Prev. Bar). This approach creates a chart with average values, displaying a smoother appearance compared to traditional candlesticks.

Practical Application Across Markets:

Whether trading stocks, forex, or cryptocurrencies, Heikin-Ashi proves adaptable. Charting platforms offer it as an option, accessible for traders across various markets. Understanding the five primary signals empowers traders to identify trends and seize profitable opportunities.

Mastering Signals: A Roadmap for Success:

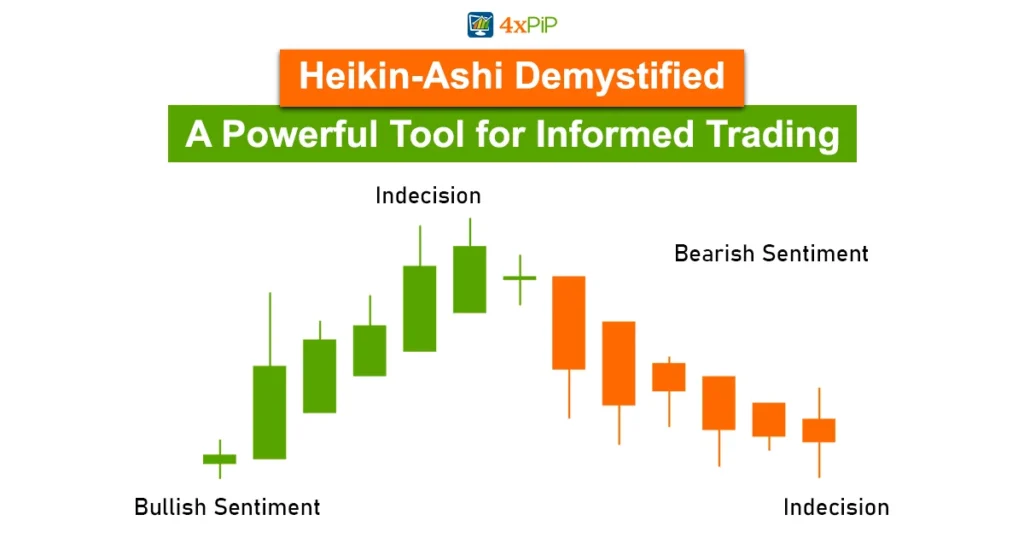

Heikin-Ashi signals serve as a roadmap. Green candles with no lower shadows indicate a robust uptrend, prompting traders to let profits ride. Red candles with no higher shadows signify a strong downtrend, signaling traders to stay short.

Analyzing Heikin-Ashi in Action: A Visual Guide:

Analyzing a chart example indicates Heikin-Ashi’s effectiveness. The consistent appearance of candles provides clarity during trends. Longer lower wicks in a downtrend indicate buying pressure, offering insights into potential trend reversals.

Reliability Check: Is Heikin-Ashi Trustworthy?

While Heikin-Ashi smoothes trends, its reliance on averages may lead to differences. Combine it with technical analysis for accurate entry and exit points, ensuring effective use.

Incorporating Heikin-Ashi into Your Toolbox:

Pair Heikin-Ashi with indicators like moving averages and Bollinger bands for effective trend analysis. Traders should experiment to find a combination that aligns with their trading style.

Conclusion:

Heikin-Ashi emerges as a powerful ally for clearer market trend understanding. Its unique formula, practical signals, and adaptable application make it a valuable addition to any trader’s toolkit.

Explore Further with 4xPip:

In this guide, 4xPip explores Heikin-Ashi, offering valuable insights. Visit 4xPip at 4xpip.com for modern trading tools. Contact [email protected] for personalized guidance and to discover our range of products for automated trading.