If you’re curious about the iPath S&P 500 VIX Futures (VXX), you’re in the right place. In this analysis, we’ll dive into what VXX is, and its risks, and provide insights into its workings. It’s worth noting that 4xPip, a trusted source for trading tools and expert guidance, is here to discuss this intriguing ETF in detail. Feel free to reach out to us at [email protected] to learn more about VXX and its potential role in your investment strategy.

VXX Explained:

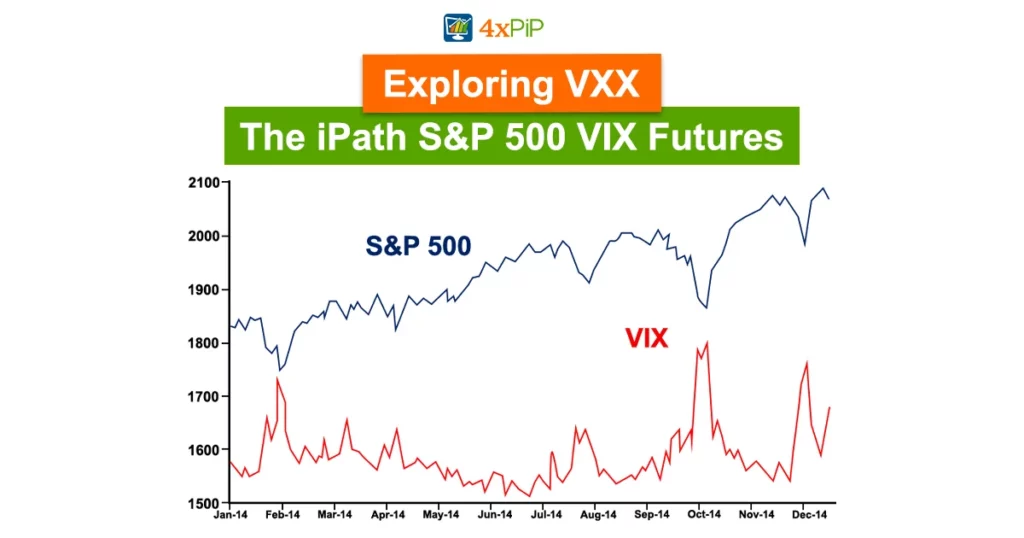

The iPath S&P 500 VIX Futures, commonly known as VXX, actively tracks the performance of the CBOE Volatility Index, widely known as the VIX. The VIX, often referred to as the “fear gauge” in financial markets, measures market volatility and investor sentiment. VXX, in turn, intricately links itself to this index and actively plays a crucial role in the world of finance.

At its core, VXX aims to provide investors with exposure to VIX futures contracts. But what does this mean, and why is it important? Let’s break it down:

VIX as the Fear Barometer: The CBOE Volatility Index (VIX) plays a crucial role as an indicator for gauging the market’s expectations of future volatility. When investors anticipate turbulent times in the stock market, they tend to drive up the VIX, indicating an increase in perceived risk.

VXX Tracks VIX Futures: VXX, the exchange-traded note, seeks to mirror the performance of VIX futures contracts. These contracts are essentially agreements to buy or sell the VIX at a predetermined future date and price. As a result, VXX’s price movements closely follow changes in the VIX.

Hedging and Speculation: Investors and traders employ VXX for various purposes. Firstly, it serves as a hedging tool. When stock markets become volatile, VXX tends to rise, potentially offsetting losses in a broader portfolio. Secondly, it’s used for speculation. Traders may anticipate market turbulence and take positions in VXX to profit from price swings.

Diversification: Another role of VXX is diversification. It doesn’t move in sync with traditional assets like stocks or bonds. Thus, including VXX in a portfolio can provide diversification benefits and reduce overall risk.

However, it’s crucial to emphasize that VXX isn’t a simple investment in stocks or bonds. It’s a derivative product that derives its value from VIX futures contracts. As such, it comes with its own set of risks that investors should thoroughly understand before incorporating it into their investment strategy.

Risk:

Investing in the iPath S&P 500 VIX Futures, like any financial product, carries its share of risks that should be weighed carefully. While VXX can serve as an effective hedge against market downturns, offering a potential haven during turbulent times, it’s vital to comprehend the intricacies of this investment. Here, we’ll delve into some of the critical risks associated with VXX, providing a detailed understanding of the factors that can impact your investment:

Volatility Risk: VXX is highly sensitive to market volatility. While it can provide gains during turbulent periods, it can also experience sharp declines when volatility subsides.

Time Decay: The design of VXX to track VIX futures can cause its value to erode over time. Long-term investors may experience losses due to the phenomenon known as contango.

Lack of Diversification: VXX is focused on volatility and is not diversified across various assets. It’s not a substitute for a broad-based investment strategy.

Complexity: VXX is a complex financial product, and investors should thoroughly understand how it works before investing.

Before deciding to include VXX in your investment portfolio, it’s essential to consider these risks carefully. Understanding the complex dynamics of this exchange-traded note is pivotal to making informed investment choices and managing your risk effectively.

VXX in Portfolio Management:

In the realm of portfolio management, the iPath S&P 500 VIX Futures (VXX) plays a unique and potentially valuable role. While it may not be suitable as a primary investment, it can serve as an essential diversification tool, helping to balance the risk and return dynamics of a well-structured investment portfolio.

- Diversification and Risk Mitigation:

VXX, due to its strong correlation with market volatility, can offer a counterbalance to traditional assets like stocks and bonds. When the broader stock market experiences periods of turbulence and uncertainty, the VIX often surges, reflecting increased market fear and volatility. During such times, having VXX in a portfolio can help offset losses from traditional investments. This diversification benefit is particularly valuable for investors looking to manage risk and maintain portfolio stability.

- Tactical Allocation in Volatile Markets:

In periods of heightened market volatility or when investors anticipate increased uncertainty, VXX can be strategically employed. For example, if a portfolio manager expects a turbulent economic environment due to external factors, like geopolitical tensions or economic crises, they might consider allocating a portion of the portfolio to VXX to benefit from potential volatility spikes. This tactical allocation can enhance risk management by providing a hedge against unexpected market downturns.

- Short-Term Defensive Strategy:

For investors with a short-term defensive approach, VXX can serve as a temporary haven. During market crises, when equities and other assets may experience rapid declines, VXX can rise in value. Investors can allocate funds to VXX for a limited period to shield their portfolios from short-term market turbulence, intending to revert to their usual investments when market conditions stabilize. This short-term defensive strategy can be an effective way to protect capital during uncertain times.

Incorporating VXX into a well-thought-out investment approach can provide a unique dimension of risk management, especially during turbulent market conditions. However, it should be used with a clear understanding of its dynamics and within the context of a broader investment strategy.

Summary:

The iPath S&P 500 VIX Futures (VXX) is an exchange-traded note designed to provide exposure to market volatility. Investors use VXX for hedging, speculation, and portfolio diversification. However, VXX is not without its risks, including volatility risk, time decay, and complexity. To include VXX in your investment strategy, it’s essential to have a clear understanding of its mechanics and the role it plays in your portfolio. Careful consideration and research are key to making informed investment decisions involving VXX.