A Forex bot, also known as an Expert Advisor (EA), is a program that automates trading on platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). It executes trades based on predefined rules, eliminating emotional decision-making, reducing manual errors, and allowing 24/7 market monitoring. For traders with specific strategies, custom Forex bot programming codes every rule, indicator, and risk parameter accurately, ensuring consistent and disciplined trade execution.

Traders can make use of 4xPip’s Custom Forex Bot Programming Services to convert their strategies into fully automated bots. This guide will walk you through the process, strategy conversion, bot development, testing, optimization, and deployment, so even beginners can automate their trading effectively while keeping their strategies secure.

Forex Bots and Their Functionality

Forex bots, also called Expert Advisors (EAs), are automated trading systems designed to execute trades on platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) according to pre-programmed strategies. By using Custom Forex Bot Programming Services, traders can ensure that their strategies are accurately translated into code, including entry and exit conditions, risk management parameters, and money management rules. Bots eliminate human emotions like fear or greed from trading decisions, ensuring consistent and disciplined execution while monitoring the market 24/7.

Automated systems offer significant advantages, including faster order execution, the ability to run multiple strategies at once, and the capacity to backtest strategies against historical data to evaluate performance before going live. However, drawbacks exist: bots can only follow the rules they are programmed with, may not adapt to sudden market changes, and require careful optimization to avoid overfitting. For traders looking to automate complex or custom strategies without coding expertise, 4xPip can convert detailed trading rules into functional bots, delivering a ready-to-use EA for MT4 or MT5.

Key Components of a Custom Forex Bot

A fully functional Forex bot consists of three essential components: strategy logic, risk management, and trade execution. Each of them plays an important role in automating trades with precision:

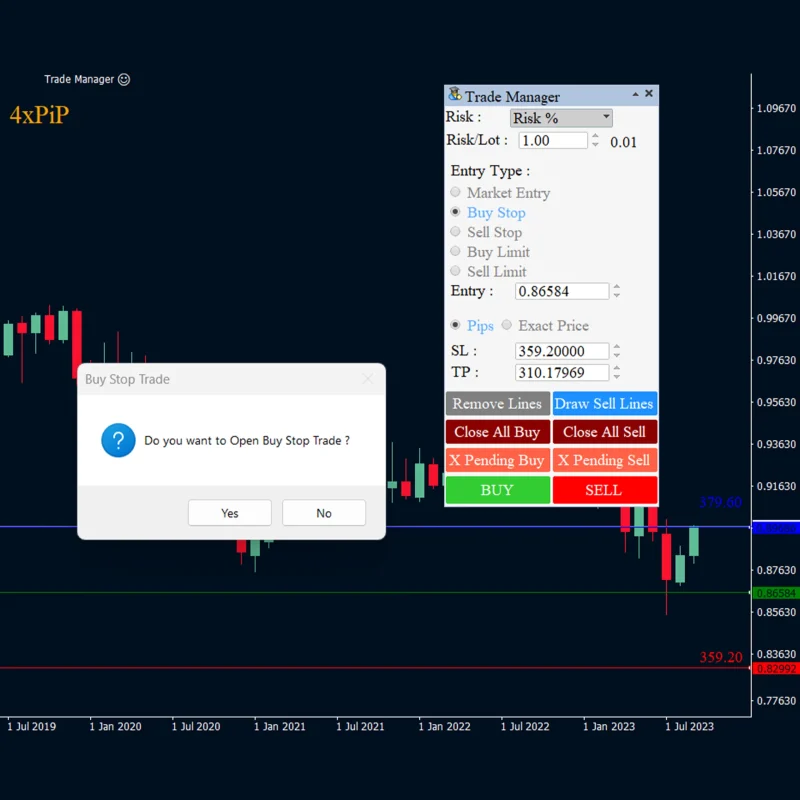

- Strategy Logic: Encodes the trader’s rules, including entry and exit points, technical indicators, and algorithmic conditions.

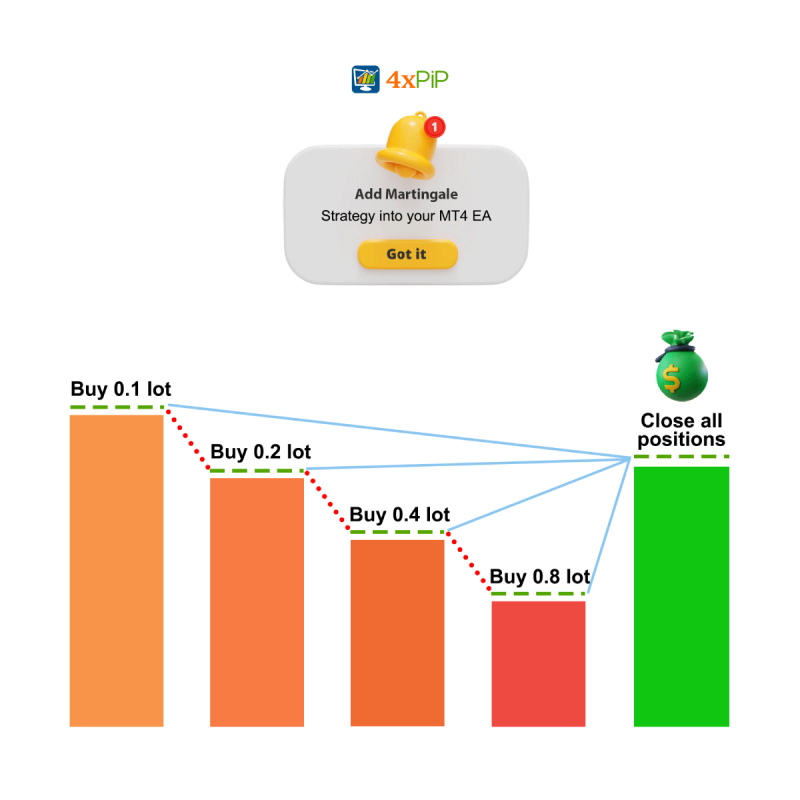

- Risk Management: Integrates stop loss, take profit, trailing stops, position sizing, and money management rules to protect capital.

- Trade Execution: Ensures orders are placed instantly and accurately, eliminating delays and errors from manual trading.

Bots also rely on indicators, technical analysis tools, and algorithm integration to make informed trading decisions. Key data inputs and parameters that influence performance include:

- Historical price data for backtesting and optimization.

- Signals from custom or standard indicators.

- Market volatility and time-frame-specific conditions.

- User-defined strategy parameters such as trade size, frequency, and stop levels.

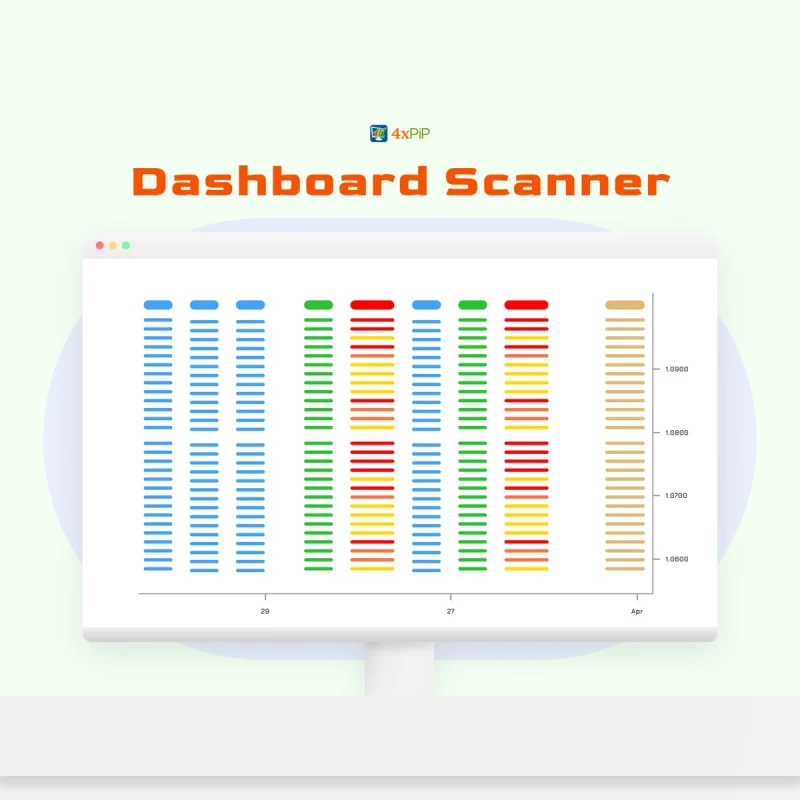

Through the expertise of 4xPip’s Custom Forex Bot Programming Services, traders receive bots with multi-strategy support, custom dashboards, and alert systems, delivered fully tested in ex4/ex5 format for MT4/MT5 while keeping the source code confidential. Traders simply provide their strategy, and the developers convert it into a fully automated bot with features like multi-strategy support, custom dashboards, and alert systems. The final product is delivered in ex4/ex5 format for MT4/MT5, fully tested and optimized, while the source code remains confidential.

Programming Languages and Platforms for Forex Bots

Forex bots are primarily developed using MQL4 and MQL5, the native programming languages for MetaTrader 4 and MetaTrader 5. These languages provide effortless integration with the platforms, allowing precise order execution, real-time data handling, and direct access to trading functions. MQL4 is generally used for simpler strategies on MT4, while MQL5 supports more complex logic, can handle several calculations at once, and advanced indicators for MT5. Choosing the right language depends on the strategy’s complexity, required execution speed, and platform features.

With years of experience in MQL4 and MQL5 development, 4xPip’s Custom Forex Bot Programming Team excels at converting trader strategies into fully functional bots. They handle everything from coding and backtesting to optimization and risk management integration, ensuring the final Expert Advisor (EA) runs smoothly on MT4 or MT5. Traders can rely on 4xPip to deliver bots that are not only accurate and efficient but also fully compatible with the chosen trading platform.

Steps in Developing a Custom Forex Bot

The first step in creating a custom Forex bot with 4xPip is requirement analysis. The trader provides their strategy, including trade entry and exit rules, risk tolerance, and performance goals. This ensures the 4xPip developers fully understand the intended logic and can translate it into a bot that executes trades exactly as defined. Clear communication at this stage also allows adding advanced money management rules, custom indicators, or multiple strategies if required.

Once requirements are defined, 4xPip’s Custom Forex Bot Programmers handle coding and implementation using MQL4/MQL5 or Pine Script for TradingView. The bot then undergoes thorough testing, including backtesting on historical data, forward testing, and demo account trials to check its performance and adjust its parameters. Traders receive the final EA in ex4/ex5 format for MT4 or MT5, with optional custom dashboards, alerts, or licensing features, ensuring the bot is ready for consistent, automated trading.

Common Challenges and Best Practices in Forex Bot Development

Developing a Forex bot involves navigating several challenges that can impact performance and reliability:

- Over-optimization (Curve Fitting): Bots tuned too closely to historical data may fail under live market conditions.

- Latency and Execution Delays: Slow order execution can cause missed opportunities, especially in fast-moving markets.

- Market Unpredictability: Sudden volatility or news events can affect trade outcomes beyond the bot’s programmed logic.

- Code Complexity: Poorly structured code can make updates, debugging, and scaling difficult.

- Maintenance and Monitoring: Without regular performance evaluation, bots may drift from intended strategy results.

Best practices to address these challenges include:

- Write Clean, Readable Code: Ensures easier updates, integration of new strategies, and long-term scalability.

- Regular Backtesting and Optimization: Continuously test against updated historical data to maintain accuracy.

- Implement Risk Management Rules: Integrate stop loss, take profit, trailing stops, and money management logic.

- Continuous Monitoring: Track live performance and adjust parameters to changing market conditions.

- Update and Maintain: Periodically revise the bot to reflect market dynamics or improvements in strategy.

At 4xPip, these practices are built into every custom bot development process. Traders and EA owners work directly with expert developers to ensure strategies are implemented accurately, optimized for performance, and protected with a licensing system. Ongoing support and revisions are available, so bots stay reliable and adaptable, while traders can focus on strategy rather than coding or technical issues.

Evaluating and Optimizing Your Custom Forex Bot

Once a custom Forex bot is developed, assessing its performance is essential. Key metrics include win rate, drawdown, and risk-adjusted returns, which help traders understand how consistently the bot executes the strategy and manages risk. At 4xPip, every bot undergoes thorough backtesting and optimization on historical data to ensure reliability without overfitting, giving EA owners confidence in real market conditions. Features like stop loss, take profit, trailing stops, and advanced money management rules are integrated to maintain disciplined trade execution.

Optimization is an ongoing process. Traders can work with 4xPip Custom Forex Bot Developers to refine the bot in response to new market data, volatility changes, or updated strategy rules. The team supports revisions, including the addition of custom indicators, multi-strategy setups, or interface enhancements, ensuring the bot adapts and remains effective over time. With 4xPip, users receive a fully functional ex4/ex5 bot while keeping their strategies confidential, making continuous improvement both secure and practical.

Summary

Custom Forex bots, also known as Expert Advisors (EAs), automate trading on platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), executing trades based on predefined rules. These bots remove emotional uncertainty, reduce manual errors, and allow 24/7 market monitoring. For traders with unique strategies, custom Forex bot programming ensures precise translation of trading rules, indicators, and risk parameters into automated execution.

4xPip’s Custom Forex Bot Programming Services enable traders, especially beginners, to convert their strategies into fully functional bots. From requirement analysis to coding, testing, optimization, and deployment, 4xPip delivers secure, reliable EAs in ex4/ex5 format. With ongoing support, multi-strategy capabilities, and custom dashboards, traders can automate trading confidently while keeping their strategies confidential.

4xPip Email Address: [email protected]

4xPip Telegram: https://t.me/pip_4x

4xPip Whatsapp: https://api.whatsapp.com/send/?phone=18382131588

FAQs

- What is a Forex bot, and how does it work?

A Forex bot, or Expert Advisor (EA), is software that automates trading on MT4 or MT5 by executing trades according to pre-programmed rules. It monitors the market continuously and applies the trader’s strategy without emotional influence. - Why should I use a custom Forex bot instead of an off-the-shelf EA?

Custom Forex bots are customized to your specific strategies, risk management rules, and indicators. Unlike generic EAs, they execute your exact trading plan, maintain discipline, and provide flexibility for multi-strategy setups. - Which platforms and programming languages are used for Forex bots?

MT4 and MT5 are the most common platforms. Developers use MQL4 to build bots for MT4 and MQL5 for MT5, with MQL5 offering more advanced strategies, multi-threading, and complex indicators. - What are the main components of a custom Forex bot?

A bot has three key modules: strategy logic (entry/exit rules, indicators), risk management (stop loss, take profit, position sizing), and trade execution (accurate, timely order placement). - How does 4xPip develop a custom Forex bot?

The process starts with a detailed strategy submission. 4xPip’s team codes the bot using MQL4/MQL5, then conducts backtesting, forward testing, and demo trials. The final EA is delivered in ex4/ex5 format with optional dashboards and alerts. - What challenges can arise in Forex bot development?

Common issues include over-optimization, execution delays, market volatility, code complexity, and lack of ongoing monitoring. These can impact performance if not addressed during development. - How can traders ensure their bot performs reliably?

Best practices include writing clean code, regular backtesting and optimization, implementing comprehensive risk management, continuous performance monitoring, and periodic updates to adapt to market changes. - How does 4xPip protect the confidentiality of my trading strategy?

4xPip delivers EAs in ex4/ex5 format without exposing source code. Licensing systems and secure coding practices ensure your strategies remain private while enabling automated execution. - What metrics should I track to evaluate my bot’s performance?

Key metrics include win rate, drawdown, and risk-adjusted returns. These help assess how consistently the bot executes your strategy and manages risk under real market conditions. - Can I modify or optimize my bot after it’s deployed?

Yes. 4xPip supports ongoing optimization, including updates to indicators, multi-strategy setups, dashboards, and interface improvements, allowing your bot to adapt to evolving market conditions.