4xPip has defined what is stop loss order and why it is used in this article. It has also explained the working of stop loss order in detail along with its pros and cons. For further information read this article and get your hands on amazing products designed by 4xPip. Let’s begin!

What is Stop loss Order?

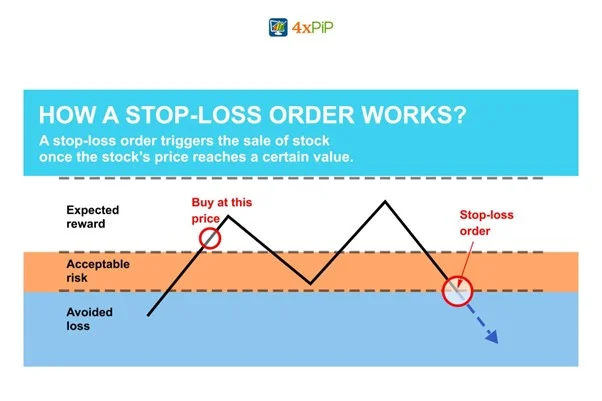

A stop loss order automatically sells a security once it reaches a certain price (either a percentage or a dollar amount below the current market price). Its purpose is to limit losses in case the security’s price drops below that price level.

Stop-loss orders are a valuable tool for risk management. They can help you protect your profits and limit your losses. However, it’s important to note that stop-loss orders are not perfect. The market price may not always reach your stop-loss price, and there is always the risk that your order will not be executed at all.

“A stop loss order is a small price to pay to protect your investment.”

How Does a Stop Loss Order Work?

Here is how a stop loss order works:

- You place a stop loss with your broker.

- The stop loss order specifies the price at which you want to sell the security.

- The market price of the security falls to or below your stop loss price.

- Your broker automatically sells the security for you at the market price.

- Your losses are limited to the amount that you set your stop loss for.

For example,

Let’s say you buy 100 shares of XYZ Company for $100 per share. You set a stop loss order at $90 per share. This means that if the price of XYZ stock falls to $90 or below, your broker will automatically sell your shares for you at the market price. This will limit your loss to $10 per share ($100 – $90).

It’s important to note that stop loss are not perfect. The market price may not always reach your stop-loss price, and there is always the risk that your order will not be executed at all. However, stop loss is a valuable tool for risk management and can help to protect your profits and limit your losses.

Why is A Stop Loss Order a Must?

A stop loss is a must because it can help to protect your profits and limit your losses. It is a type of order that automatically sells security once it reaches a certain price (either a percentage or a dollar amount below the current market price). This is designed to limit losses in case the security’s price drops below that price level.

Here are some of the reasons why stop loss order is a must:

It can help you to protect your profits. If you have a stop loss order in place, you will be automatically sold out of a security if the price starts to fall. This will prevent you from losing all of your profits if the price continues to fall.

It can help you to limit your losses. If the price of a security starts to fall, a stop loss order will automatically sell it for you at a predetermined price. This will limit your losses to the amount that you set your stop loss for.

It can help you to stay disciplined. It can be difficult to sell a security at a loss, especially if you believe that the price will eventually go back up. However, a stop loss can help you to stay disciplined and sell the security before you lose too much money.

It can help you to avoid emotional trading. When the market is moving against you, it can be easy to get emotional and make bad trading decisions. However, a stop loss can help you to avoid making emotional decisions and protect your profits.

Overall, stop loss orders are a valuable tool for risk management. They can help you to protect your profits and limit your losses. If you are serious about investing, it is important to use stop loss orders to protect your investments.

What If We Don’t Use A Stop loss Order?

There are a few disadvantages to not using a stop loss order, including:

You could lose more money than you intended. If the market price of a security falls sharply, you could lose a lot of money if you don’t have a stop loss order in place.

You could miss out on opportunities to profit. If the market price of security starts to fall but then rebounds, you could miss out on the opportunity to profit if you don’t have a stop loss order in place.

You could make emotional trading decisions. When the market is moving against you, it can be easy to get emotional and make bad trading decisions. If you don’t have a stop loss in place, you may be more likely to make emotional decisions that could lead to losses.

You could be taken advantage of by market makers. Market makers are professionals who make money by buying and selling securities. If they know that you don’t have a stop loss order in place, they may be more likely to manipulate the market price of a security to trigger your stop loss order and sell you the security at a lower price.

Overall, there are several disadvantages to not using a stop loss . If you are serious about investing, it is important to use stop loss orders to protect your investments.

How to Use Stop loss Effectively?

Here are some additional tips for using stop loss effectively:

Set your stop loss price at a level that you are comfortable with. You don’t want to set your stop loss price so close to the current market price that it is likely to be triggered by a small fluctuation in the price. However, you also don’t want to set your stop loss price so far away that it is unlikely to be triggered before your losses become significant.

Use stop loss orders on all of your trades. Don’t just use stop loss on your losing trades. Use them on all of your trades, including your winning trades. This will help you to protect your profits and limit your losses, regardless of the direction of the market.

Be patient. The market price may not always reach your stop-loss price. If the market price is moving in your favor, you may want to wait until it reaches a more favorable level before placing your stop-loss order.

Monitor your stop-loss orders regularly. The market conditions can change quickly, so it’s important to monitor your stop-loss orders regularly and make sure they are still appropriate. If the market conditions change significantly, you may need to adjust your stop-loss prices.

Stop loss orders are a valuable tool for risk management, but they are not a guarantee against losses. By following these tips, you can use stop loss orders to effectively protect your profits and limit your losses.

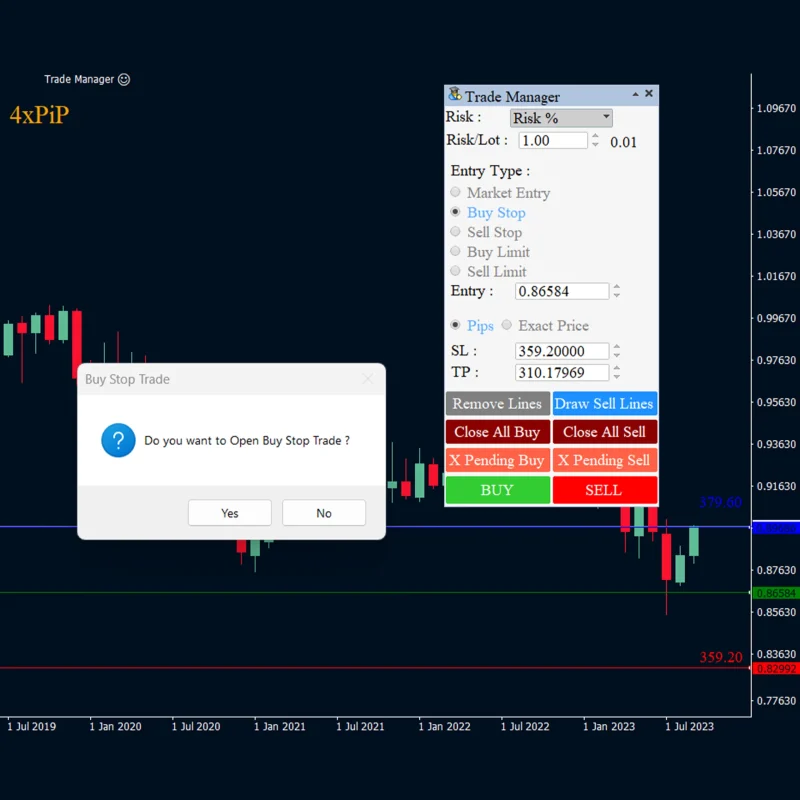

4xPip also provides automation of trading through indicators and Expert Advisors (EA). For Stoploss, you can use 4xPip’s products like MT4 Trailing Stoploss EA and MT5 Trailing Stoploss EA.

Summary:

A stop loss order automatically sells a security if the price falls to a certain level. Its purpose is to limit losses in case the security’s price drops below that level. Investors consider stop loss orders an important risk management tool as they can help protect profits and prevent losses from getting out of hand.

If you don’t use stop loss orders, you risk losing more money than you can afford to lose. This is because the market price of a security can fluctuate quickly, and if it falls sharply, you could lose a lot of money before you have a chance to sell. Stop loss orders can help prevent this by automatically selling your security if the price falls to a certain level.

Here is an example of how a stop loss order can work:

- You buy 100 shares of XYZ Company for $100 per share.

- You set a stop loss order at $90 per share.

- The price of XYZ stock falls to $90 or below.

- Your broker automatically sells your shares for you at the market price.

- This limits your loss to $10 per share ($100 – $90).

As you can see, stop loss orders can be a very effective way to protect your profits and limit your losses. If you are serious about investing, it is important to use stop loss orders to manage your risk.